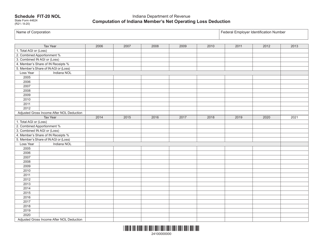

41 nol calculation worksheet excel

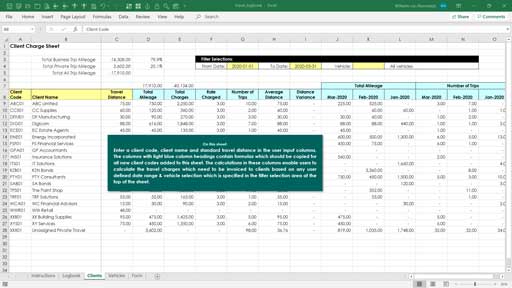

Net Operating Loss Carryback/Carryover Calculator This calculator helps you calculate your NOL deduction and any remaining NOL that you may carry to another year. ? Net Operating Loss Carryback/Carryover * indicates required. Net Operating Loss Carryback/Carryover Inputs Client name:* Year in which the NOL occurred:* 1980 1993 2006 2020 Year to which the NOL is being carried:* 1994 2002 2011 2020 Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

1040-US: NOL Carryover Calculation Worksheet 1, line 2 - Thomson Reuters Answer Note: The NOL deduction can be found on NOL Carryover Calculation Worksheet 1, line 1. For additional information on the calculation of the NOL worksheets, see IRS Publication 536, Net Operating Losses (NOLs) for Individuals, Estates, and Trusts.

Nol calculation worksheet excel

Intermediate Accounting, 3e | myBusinessCourse 16.11.2022 · The cross-l isting to E v olution Curriculum learning object i v es also app l ies to the n e w Excel-based data analytic problems that meet a number of the data analytic goals. A comprehens i v e grid sh o wing the E v olution Curriculum learning object i v es matched to Intermediate Accountin g , 3e learning object i v es and spec i f ic assignments is a v ai l able … Form 1041 Workshop with Filled-in Forms - CPE Now Calculation of DNI utilizing three different methods, a “forms” method (Schedule B), a “code” method, and a “shortcut” method, utilizing a worksheet of common income and expenses; Proper W-2 preparation and procedures in the year of death; Taxpayer passes before taking a required minimum distribution; what must be done? All Department | Forms & Instructions | NH Department of … Net Operating Loss (NOL) Worksheet See Form for Instructions: DP-132 (fillable) DP-132 (print) Net Operating Loss (NOL) Deduction Worksheet See Form for Instructions: DP-132-WE (fillable) DP-132-WE (print) Combined Group Net Operating Loss (NOL) Deduction Worksheet See Form for Instructions: DP-135 (fillable) DP-135 (print) Communications Services Tax Return See …

Nol calculation worksheet excel. Desktop: Form 1045, Net Operating Loss Worksheet - Support Enter the number of years you wish to carry back the NOL Select the year you want to apply the NOL to first and complete the worksheet for that year. If you wish to forego the carryback period, select IRC Sec 172 (b) (c) Election to Forego the Carryback Period. Note: This is a guide on completing Form 1045 in the TaxSlayer Pro program. 10++ Electrical Load Calculation Worksheet Excel Source: db-excel.com. Calculate size of diesel generator. Load on b phase : Source: db-excel.com. The residential load calculation worksheet calculates the electrical demand load in accordance with article 220 of the 2017 national electrical code. The worksheet helps to provide an. Source: db-excel.com. This section is dedicated to tools every ... How to Calculate Net Operating Loss: A Step-By-Step Guide - FreshBooks Calculate the Net Operating Losses The next step is to determine whether you have a net operating loss and its amount. For example, if your business has a taxable income of $700,000, tax deductions of $900,000 and a corporate tax rate of 40%, its NOL would be: $700,000 - $900,000 = -$200,000. pages.stern.nyu.edu 11/1/2022. 74863 53823 0.75. 12368 6523 0.75. 229 358. 28494 30189. 10158 8904. 16095 18915. 0 0. 0 0. 3468. 210. 0.1. 0.25. 0.55262211463044819

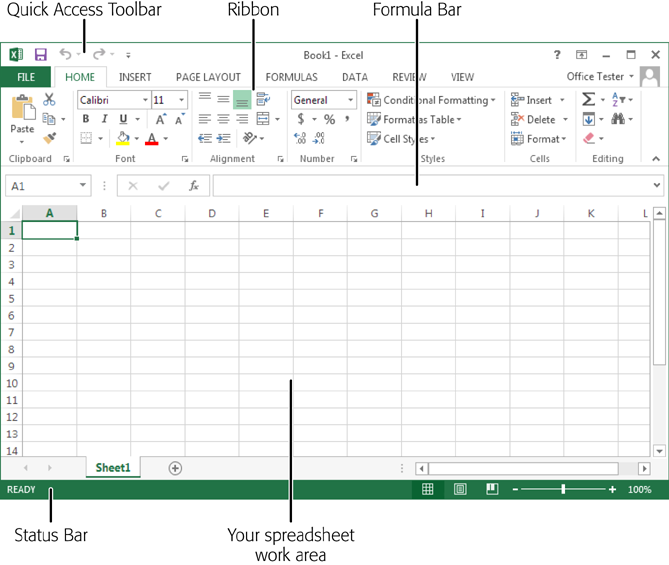

Worksheet.Calculate method (Excel) | Microsoft Learn Worksheet.Calculate method (Excel) Article 09/13/2021; 2 minutes to read; 6 contributors Feedback. In this article. Calculates all open workbooks, a specific worksheet in a workbook, or a specified range of cells on a worksheet, as shown in the following table. ... Worksheets(1).Rows(2).Calculate: Example. This example calculates the formulas ... What are Net Operating Losses? Formula + NOLs Calculator - Wall Street Prep NOLs Carry-Back = $250k + $250k = $500k Furthermore, the tax savings can be calculated by multiplying the sum of the NOL carry-back and carry-forward by the tax rate assumption. For each fiscal year, the ending balance of the NOLs can be calculated from the following steps: NOLs Beginning Balance Plus: NOLs Generated (Current Period) nol carryforward worksheet Form Corp-NOL Nebraska Corporation Net Operating Loss Worksheet formupack.com. nebraska nol ne forms operating loss corp tax worksheet. Reading Online Activity For A2 . reading a2 comprehension worksheet link. Nol Calculation Worksheet Excel - Worksheet List nofisunthi.blogspot.com. nol. 11 Printable Spreadsheet Calculator ... nol carryover worksheet Nol Calculation Worksheet Excel ivuyteq.blogspot.com. nol irs calculation computation internal ivuyteq. Form dp-132 download fillable pdf or fill online net operating loss. Tax loss carry forward: using tax loss carry forward. Solved: nol carryforward worksheet or statement.

nol carryforward worksheet Nol Calculation Worksheet Excel - Worksheet List nofisunthi.blogspot.com nol Form Corp-NOL Nebraska Corporation Net Operating Loss Worksheet formupack.com nebraska nol ne forms operating loss corp tax worksheet Beginning Steps To Reading specialconnectionhomeschool.blogspot.com adaptable simply stickers less others were minnesota flea market calendar - fgt.spigotadjustersal.shop minnesota flea market calendar120 Days of Sodom - odaha.comShim-pack Scepter C18 -120 [metal free] (100 mm × 2.1 mmI.D., 3 µm), P/N:227-31073-02 Mobile phase A :New Free 120 (Step 2 CK) These answer explanations are and always will be free.However, given multiple email requests, I will post my Venmo (@Adam-Zakaria-SLO) if you want to send a few dollars to … Publication 536 (2021), Net Operating Losses (NOLs) for Individuals ... NOL Steps Follow Steps 1 through 5 to figure and use your NOL. Step 1. Complete your tax return for the year. You may have an NOL if a negative amount appears in these cases. Individuals—You subtract your standard deduction or itemized deductions from your adjusted gross income (AGI). Is there a spreadsheet to assist in calculating NOL carryforward ... Is there a spreadsheet to assist in calculating NOL carryforward schedule A and where can I find it. - Answered by a verified Tax Professional. We use cookies to give you the best possible experience on our website. ... Here is a link to the IRS worksheet and its instructions. Please let me know if you need additional assistance.

(PDF) Introduction to chemical engineering - Academia.edu Academia.edu is a platform for academics to share research papers.

Net Operating Loss (NOL) - Overview, NOL Carryback, NOL Carryforward The benefit of carrying an NOL carryback is to get a refund on a company's previous years' tax liability. The year that the NOL occurs will be identified as the NOL year. From that point in time, the company can carry the amount back to the previous two years. However, companies can carry the amount back for three years under special ...

Education Development Center data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAAAKAAAAB4CAYAAAB1ovlvAAAAAXNSR0IArs4c6QAAArNJREFUeF7t1zFqKlEAhtEbTe8CXJO1YBFtXEd2lE24G+1FBZmH6VIkxSv8QM5UFgM ...

1120 income calculation worksheet Nol Calculation Worksheet Excel - Worksheet List nofisunthi.blogspot.com. nol calculation. How Much Is A 2nd Income Really Going To Bring In? . spreadsheet. Rental Income Calculation Worksheet As Well As Investment Property .

What Is Net Operating Loss (NOL)? - The Balance Small Business How to Calculate and Report a Net Operating Loss To calculate and report NOL, here are some key steps to follow: Begin by completing your tax return for the year, including your business income or loss. Use the calculation above to get a tentative calculation for NOL. Check to see if you have a net operating loss.

Net Operating Loss Carryover Worksheet - Nol Carryover Worksheet Excel ... Nol carryover from 2020 to 2021. Use this worksheet to compute your nebraska net operating loss (nol) for tax years after 2017 that is available for carryback or carryforward. Enter the tax year a michigan net operating loss (nol) was created. Losses must be applied in the order in which they occurred.

Amt Nol Calculation Worksheet - ifiamsup.com Amt Nol Calculation Worksheet. AMT may thus reduce the relative disincentive to invest abroad, encouraging more investment abroad than otherwise.

Net Operating Loss (NOL) - Calculation Worksheet - Thomson Reuters Net Operating Loss (NOL) - Calculation Worksheet This tax worksheet calculates a personal income tax current year net operating loss and carryover. If a taxpayer's deductions for the year are more than their income for the year, the taxpayer may have an NOL.

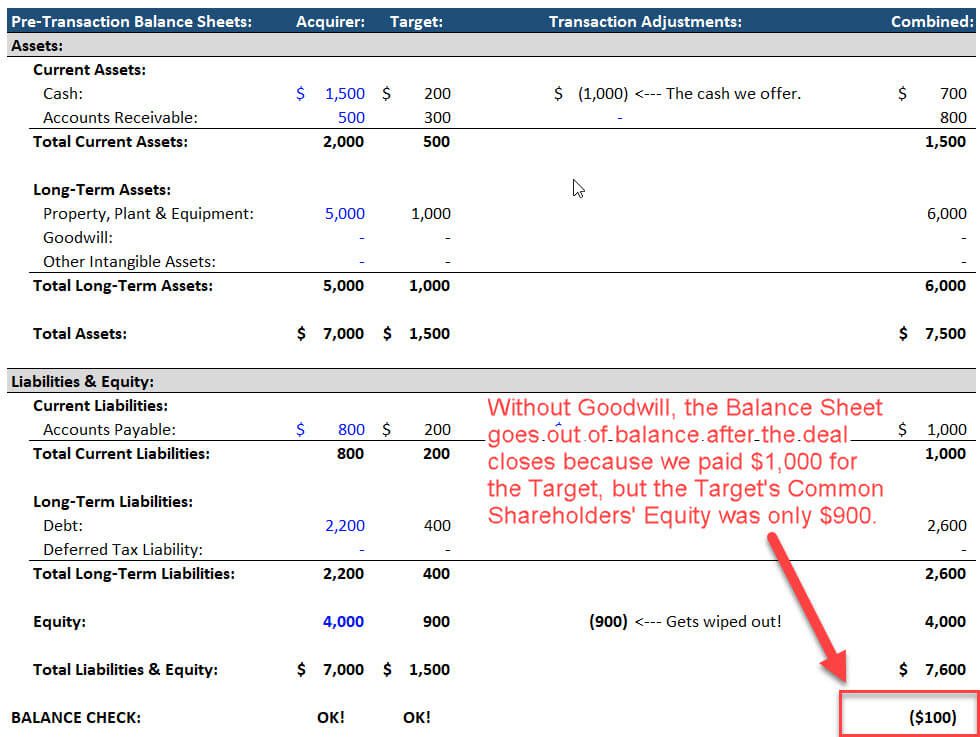

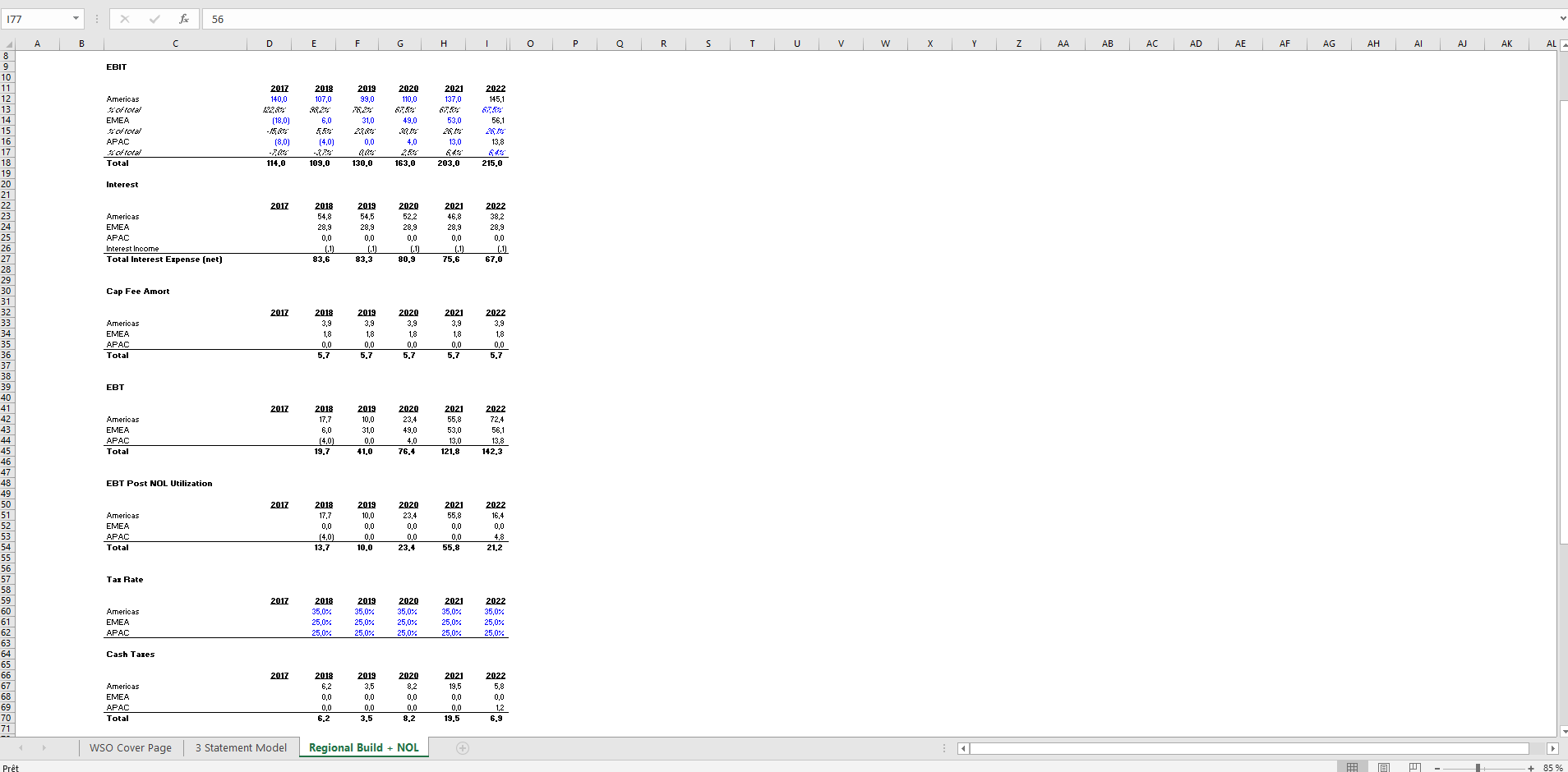

NOL | Net Operating Loss - Macabacus Assuming a corporate tax rate of 35%, a $100 NOL is worth $35 today, but will be worth less in the future. The discount rate used to calculate the PV of NOL should reflect the probability that a company can generate sufficient taxable income in the future to utilize the NOL; otherwise, the NOL will expire unused and worthless.

(PDF) Handbook of Industrial Drying - Academia.edu Sugarcane bagasse is becoming more and more commonly used in generating electrical energy, steam, and bioethanol. Drying is important in sugarcane and other types of biomass because it can be used to improve the calorific value and overall energetic use.

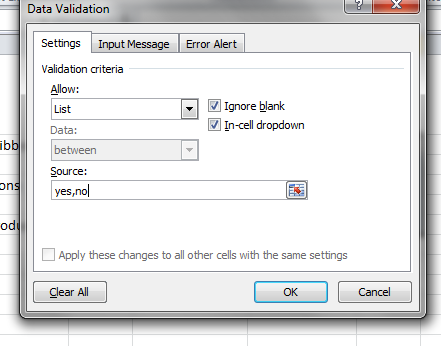

Recalculating the worksheet - Microsoft Excel 365 - OfficeToolTips The Automatic option, used by default, means that Excel will automatically recalculate any dependent formulas every time worksheet data changes.; The Automatic Except for Data Tables option means that Excel will automatically recalculate any dependent formulas except data tables.. Note: This option will disable Excel calculations for data tables only, while a regular Excel spreadsheet will ...

(PDF) Dictionary of Accounting Terms.pdf - Academia.edu Enter the email address you signed up with and we'll email you a reset link.

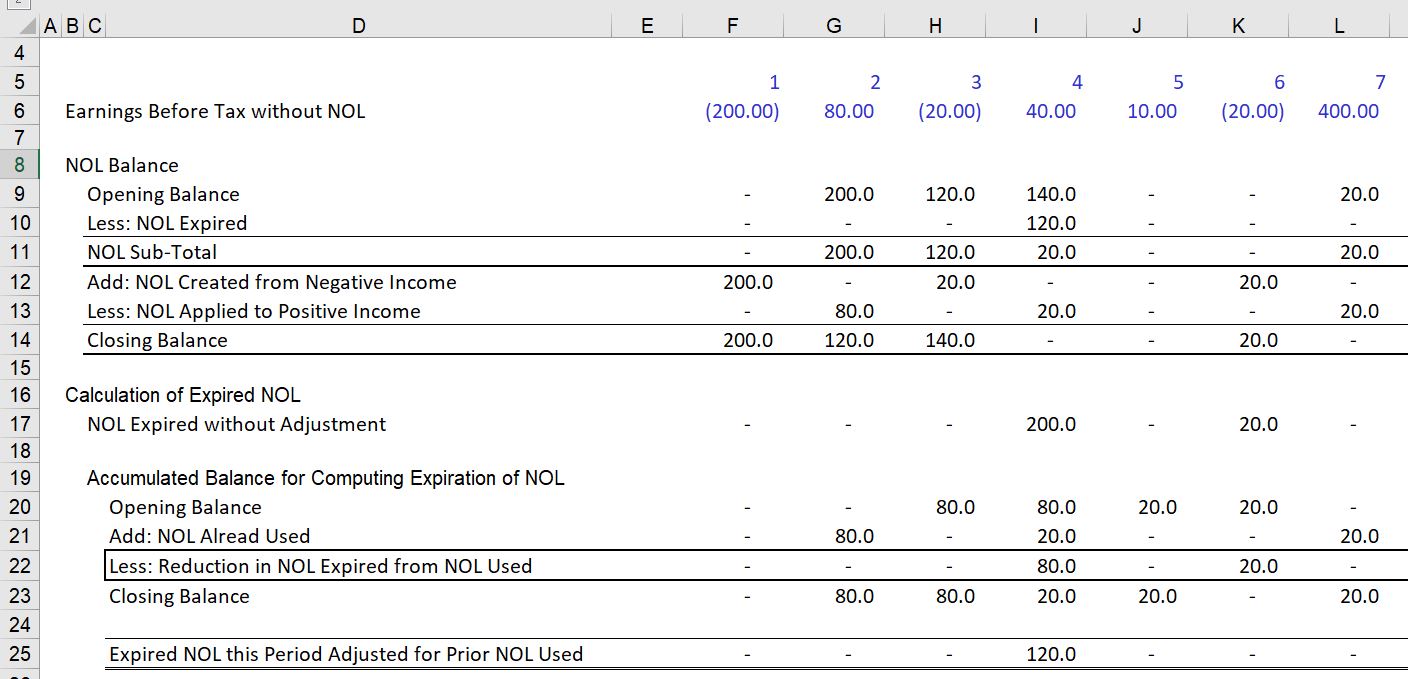

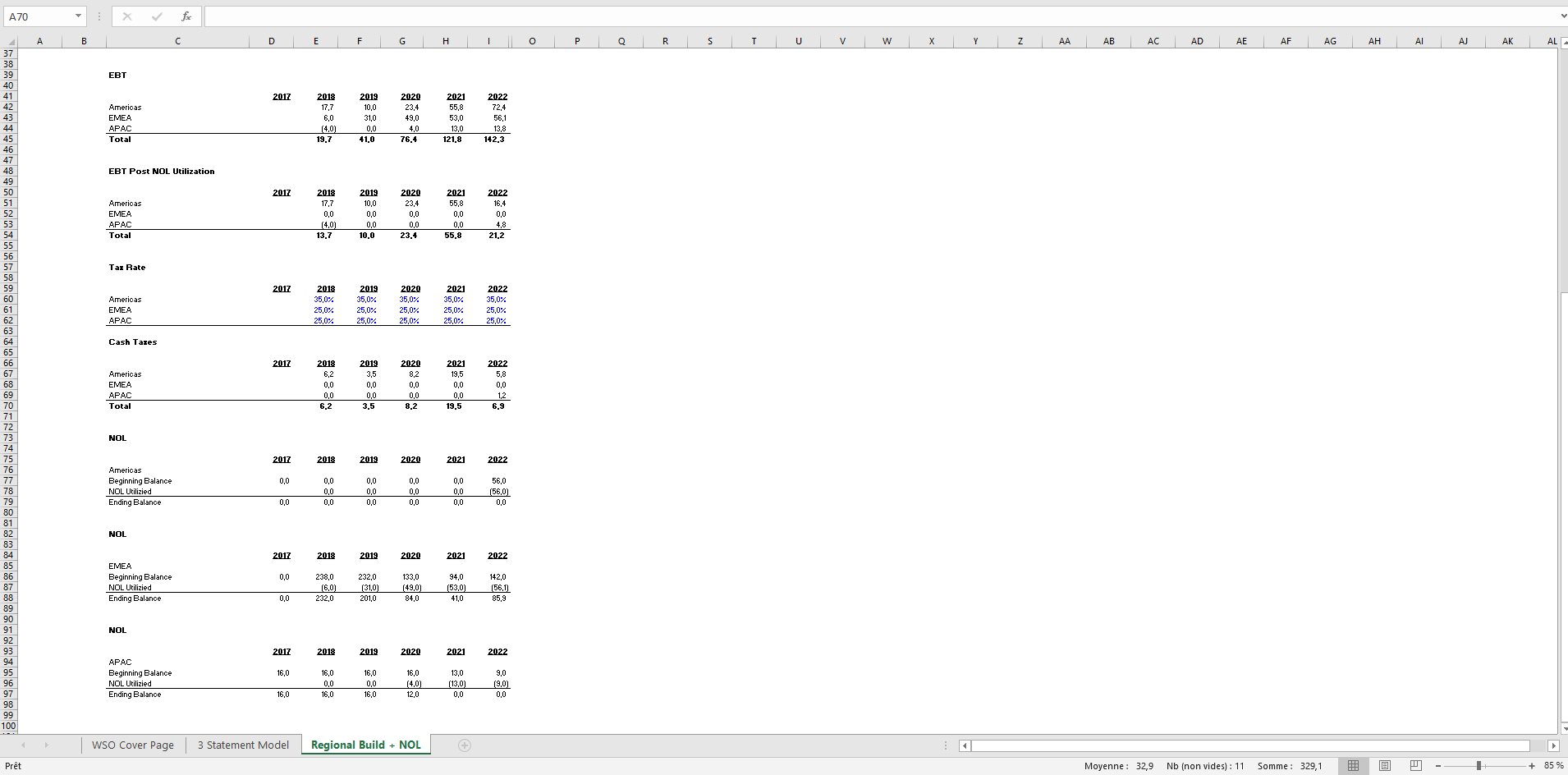

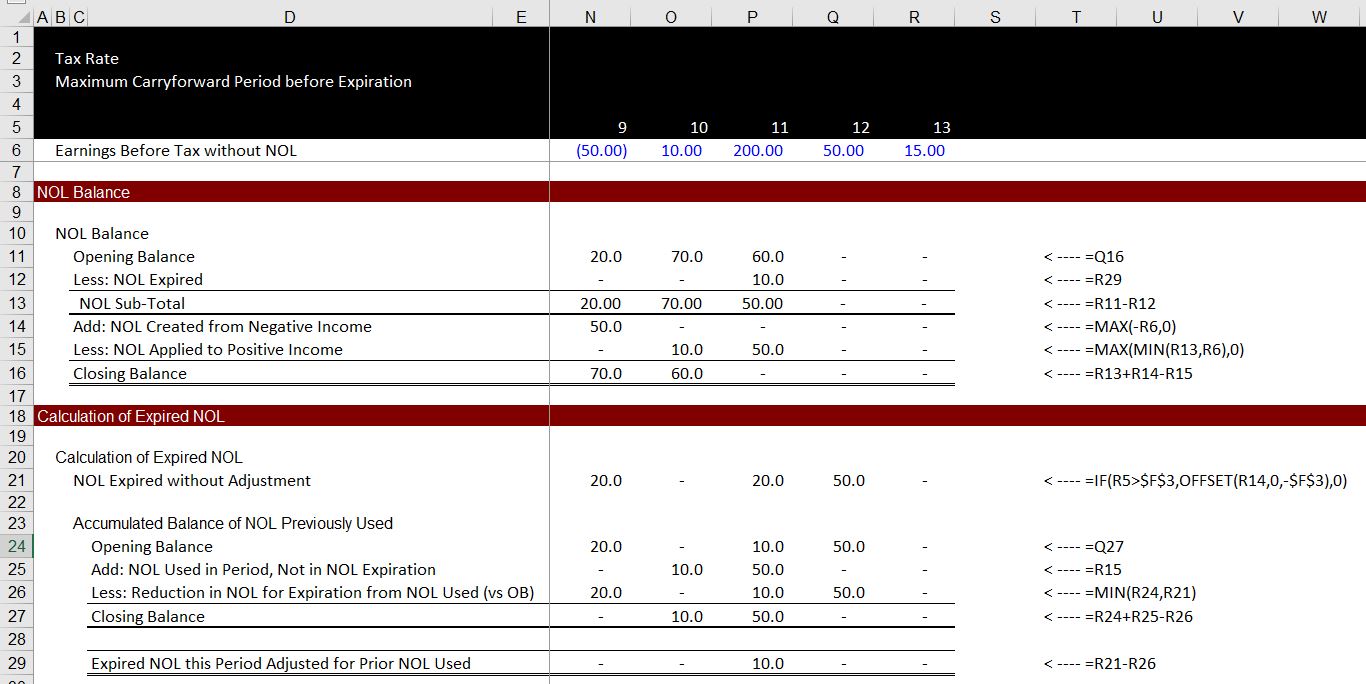

NOL Tax Loss Carryforward - Corporate Finance Institute Create a subtotal line Create a line to calculate the loss used in the period with a formula stating that "if the current period has taxable income, reduce it by the lesser of the taxable income in the period and the remaining balance in the TLCF. Create a closing balance line equal to the subtotal less any loss used in the period

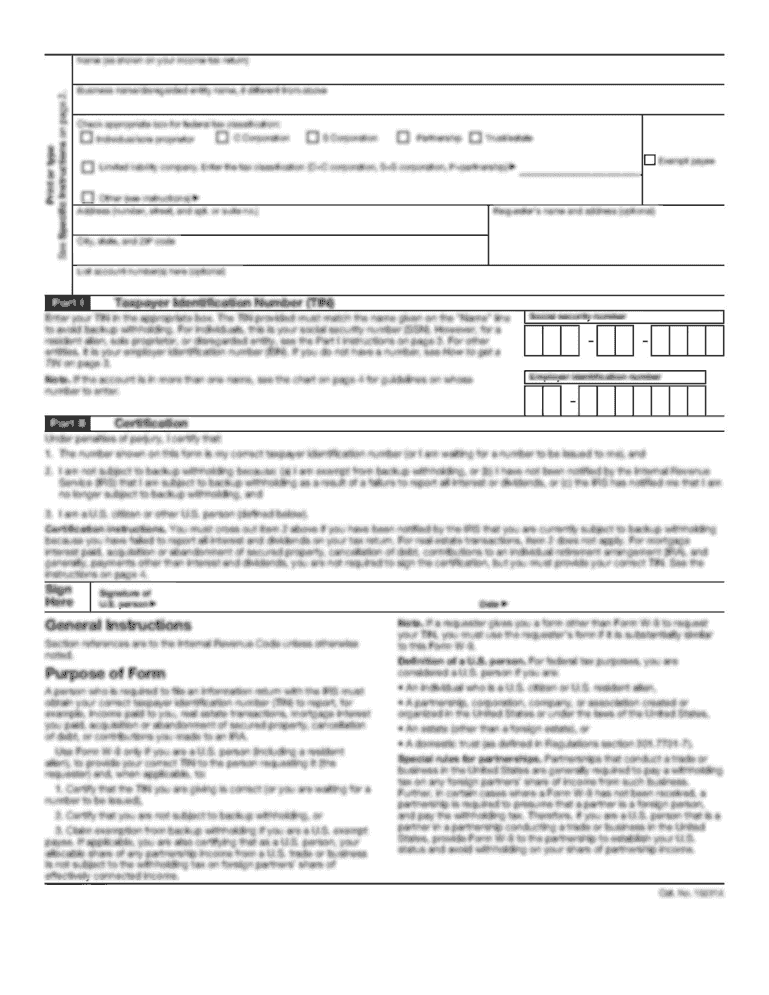

Hud Rent Calculation Worksheet Excel Form - signNow Follow the step-by-step instructions below to design your hud resident rent calculation worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

AMT NOL Calculation Worksheet | PDF | Alternative Minimum Tax | Tax ... AMT NOL Calculation Worksheet Uploaded by caixinran Description: AMT NOL Calculation Worksheet Copyright: Attribution Non-Commercial (BY-NC) Available Formats Download as PDF, TXT or read online from Scribd Flag for inappropriate content Save 0% 0% Embed Share Print Download now of 2 Alternative Minimum Tax Net Operating Loss Worksheet A

Net Operating Loss Carryforward Template | Wall Street Oasis Download WSO's free Net Operating Loss Carryforward model template below!. This template allows you to model a company with net operating losses and carry them forward throughout the model.. The template is plug-and-play, and you can enter your own numbers or formulas to auto-populate output numbers. The template also includes other tabs for other elements of a financial model.

Worksheet.EnableCalculation property (Excel) | Microsoft Learn In this article. True if Microsoft Excel automatically recalculates the worksheet when necessary.False if Excel doesn't recalculate the sheet. Read/write Boolean.. Syntax. expression.EnableCalculation. expression A variable that represents a Worksheet object.. Remarks. When the value of this property is False, you cannot request a recalculation.When you change the value from False to True ...

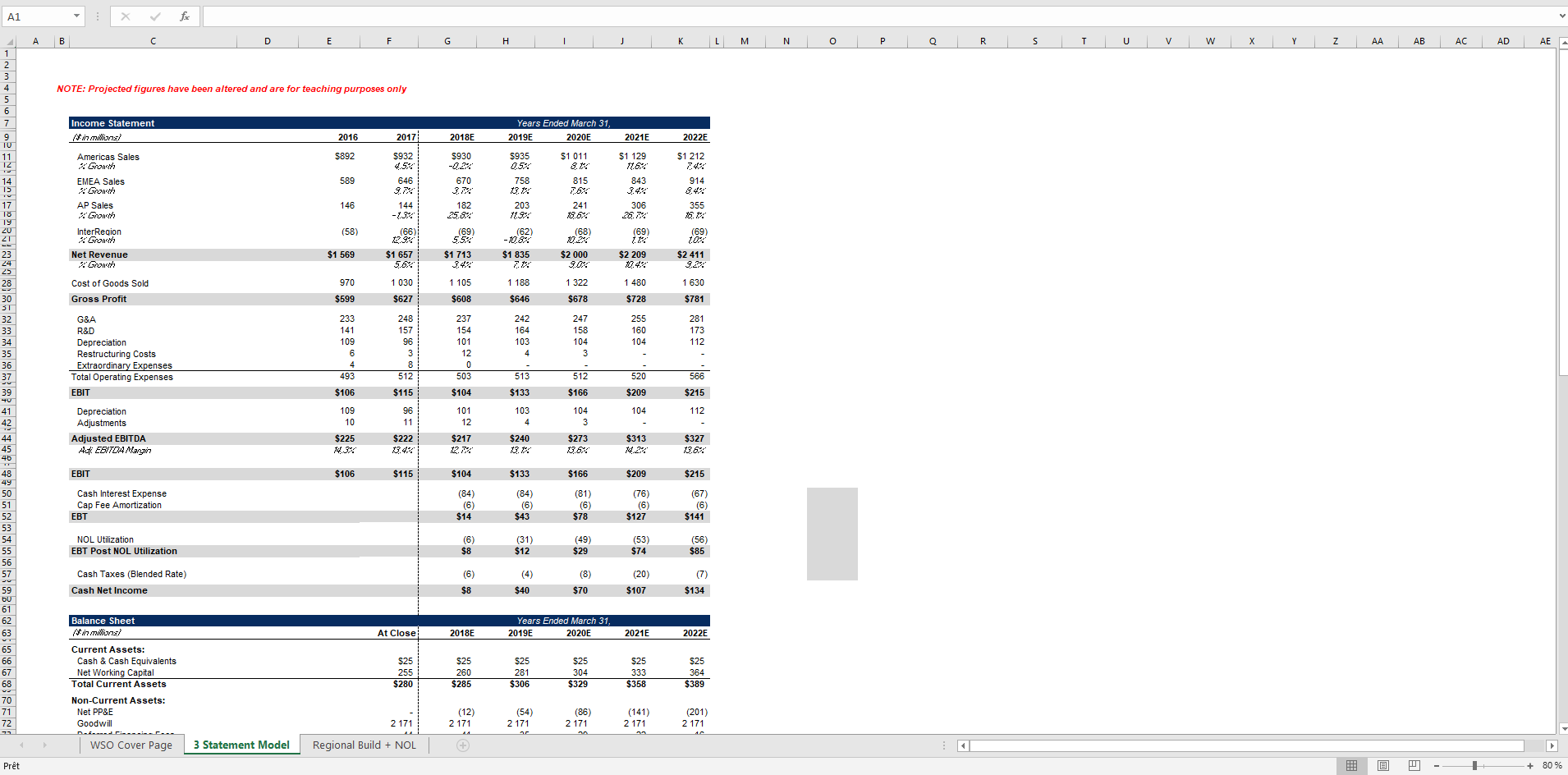

Net Operating Loss (NOL) Carryforward - Excel Model Template 3 Statement Model: Accompanying the NOL model is a Three Statement Model containing an Income Statement, Balance Sheet, and Cash Flow Statement - all fully editable for your own use. The figures already included in the template are for explanatory purposes only and seek to help the user understand the model and where to input their own data.

nol carryforward worksheet Nol calculation worksheet excel. California forms loss capital tax form schedule. Random Posts. Maths Acitivy For Preschool Worksheet; Paris 1st Grade Worksheet; Kindergarten Blank Writing Worksheet; Measuring Inches Worksheet Second Grade; My Face Worksheet Preschool; Preschool Beach Worksheet; Parallax And Distance Worksheet Answers;

Chemical engineering design - GAVIN TOWLER, RAY … Enter the email address you signed up with and we'll email you a reset link.

Income Calculation Worksheet - NRPS Right click on the below link, select "open in a new tab" to launch the Income Calculation Worksheet: Income Calculation Worksheet Income Calculation Worksheet is required to be utilized on all wag...

nol calculation worksheet 263A. 8 Images about 263A : Fillable Form Nol-Pre-99 - Net Operating Loss (Nol) Worksheet printable pdf download, Nol Calculation Worksheet Excel - Worksheet List and also ATNOLs and Charitable Contribution Carryovers: Which Takes Precedence?. 263A studylib.net. 263a spreadsheet calculation unicap template excel db lifo sec costs

All Department | Forms & Instructions | NH Department of … Net Operating Loss (NOL) Worksheet See Form for Instructions: DP-132 (fillable) DP-132 (print) Net Operating Loss (NOL) Deduction Worksheet See Form for Instructions: DP-132-WE (fillable) DP-132-WE (print) Combined Group Net Operating Loss (NOL) Deduction Worksheet See Form for Instructions: DP-135 (fillable) DP-135 (print) Communications Services Tax Return See …

Form 1041 Workshop with Filled-in Forms - CPE Now Calculation of DNI utilizing three different methods, a “forms” method (Schedule B), a “code” method, and a “shortcut” method, utilizing a worksheet of common income and expenses; Proper W-2 preparation and procedures in the year of death; Taxpayer passes before taking a required minimum distribution; what must be done?

Intermediate Accounting, 3e | myBusinessCourse 16.11.2022 · The cross-l isting to E v olution Curriculum learning object i v es also app l ies to the n e w Excel-based data analytic problems that meet a number of the data analytic goals. A comprehens i v e grid sh o wing the E v olution Curriculum learning object i v es matched to Intermediate Accountin g , 3e learning object i v es and spec i f ic assignments is a v ai l able …

0 Response to "41 nol calculation worksheet excel"

Post a Comment