41 worksheet for figuring net earnings loss from self employment

PDF SELF EMPLOYMENT INCOME WORKSHEET - caclmt.org - Net Losses (if a net loss is incurred during any of the months listed, then that month's income will equal zero, not a negative value.) > Allowable expenses that can be deducted from income are listed below within the worksheet (#4-17). -Income Taxes (federal, state, and local) EXPENSES: 2. Other Income (specify sources): 3. Total Gross Income Knowledge Base Solution - How do I suppress the self-employment income ... Go to the Partners > General Options worksheet.. Select Section 2 - Schedule K-1 Calculations Options.. Select Line 6- Suppress the self-employment income calculation and schedule.; Calculate the return. Note: If none of the income from this partnership is self-employment income, an "X" on this line suppresses both the calculation and printing of the Net Earnings from Self-Employment worksheet.

Publication 334 (2021), Tax Guide for Small Business VerkkoThe maximum net self-employment earnings subject to the social security part of the self-employment tax is $147,000 for 2022. Standard mileage rate. ... The cost or purchase price of property is usually its basis for figuring the gain or loss from its sale or other disposition. However, if you acquired the property by gift, by inheritance, ...

Worksheet for figuring net earnings loss from self employment

Publication 17 (2021), Your Federal Income Tax - IRS tax forms VerkkoYou must include income from services you performed as a minister when figuring your net earnings from self-employment, unless you have an exemption from self-employment tax. This also applies to Christian Science practitioners and members of a religious order who have not taken a vow of poverty. For more information, see Pub. 517. Publication 502 (2021), Medical and Dental Expenses Verkko13.1.2022 · Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Calculating Net Earnings for Business Taxes - The Balance Small Business Calculating Net Earnings for Self-employment Taxes The net earnings total forms the basis for calculating self-employment taxes on Schedule SE. Some income does not count for Social Security and should not be included in figuring your net earnings: Dividend income: unless it is received as a dealer in stocks and securities

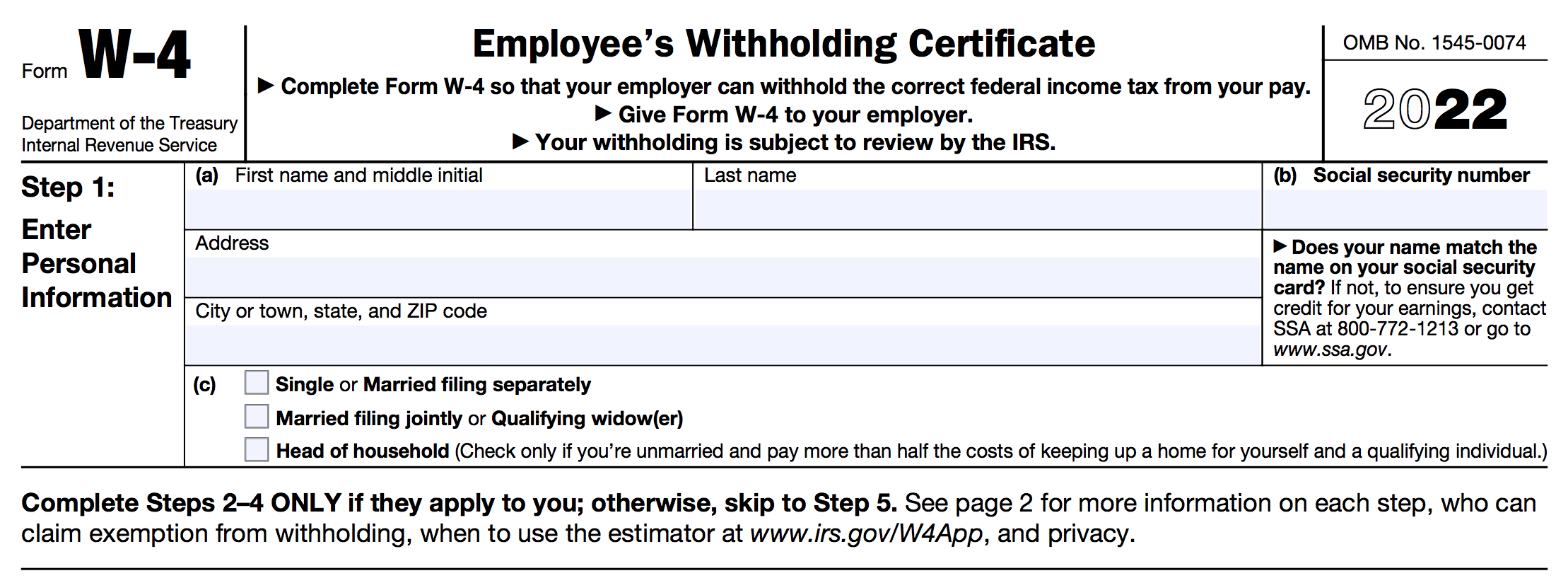

Worksheet for figuring net earnings loss from self employment. › publications › p502Publication 502 (2021), Medical and Dental Expenses Jan 13, 2022 · Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. › publications › p3Publication 3 (2021), Armed Forces' Tax Guide | Internal ... Publication 3 - Introductory Material What's New Reminders Introduction. Due date of return. File Form 1040 or 1040-SR by April 18, 2022. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia—even if you don’t live in the District of Columbia. PDF Income Calculations - Freddie Mac Form 91 is to be used to document the Seller's calculation of the income for a self-employed Borrower. This form is a tool to help the Seller calculate the income for a self-employed Borrower; the Seller's calculations must be based on the requirements and guidance for the determination of stable monthly income in Topic 5300. Publication 505 (2022), Tax Withholding and Estimated Tax VerkkoIf you file a joint return and both you and your spouse have net earnings from self-employment, each of you must complete a separate worksheet.. Expected Taxable Income— Line 2 Reduce your expected AGI for 2022 (line 1) by either your expected itemized deductions or your standard deduction.

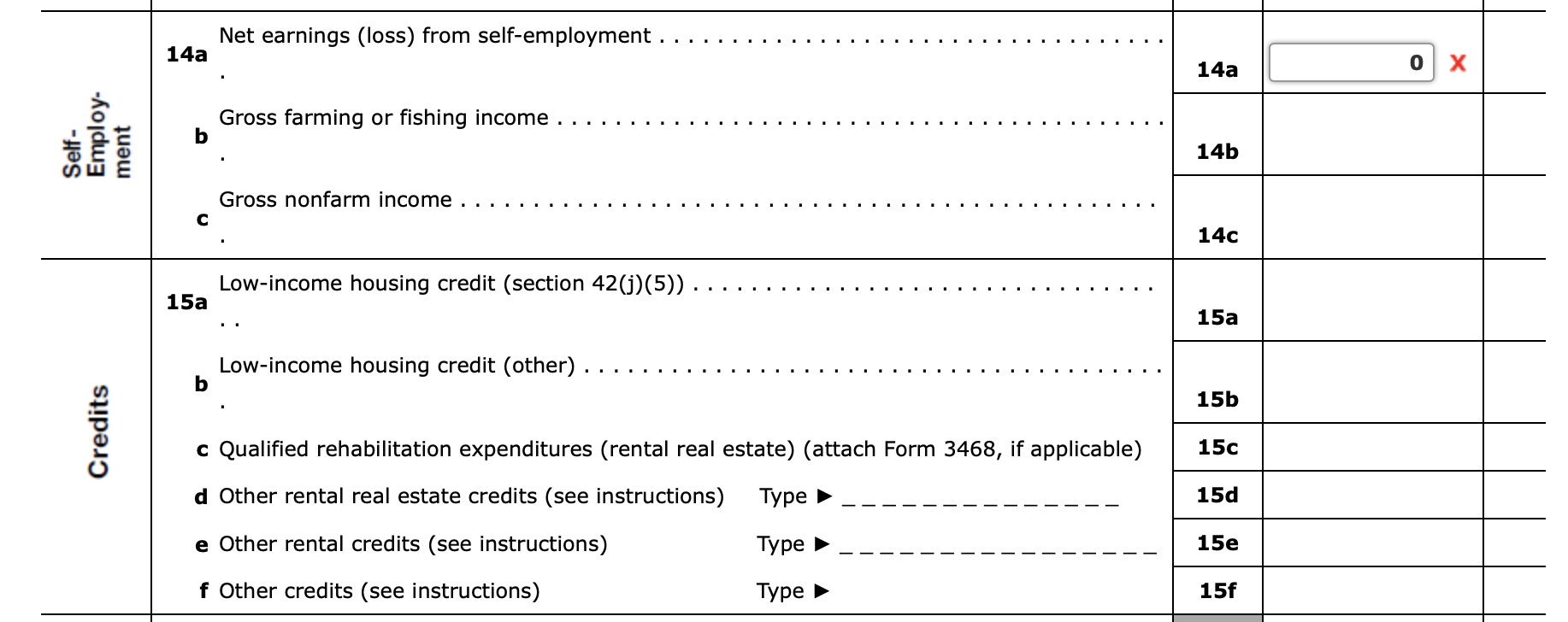

1065-US: Calculating Schedule K, line 14a - Net earnings from self ... Answer UltraTax CS calculates self-employment earnings (SE) per activity for partners in the Partner's Self-Employment Worksheet based on the type of partner selected in the Partner tab in the Partner Information window in View > Partner Information. General Partner and LLC Member (SE Income) calculate SE for all applicable items. Instructions for Form 1065 (2021) | Internal Revenue Service Line 14a. Net Earnings (Loss) From Self-Employment . Schedule K. Schedule K-1. Line 14b. Gross Farming or Fishing Income ; Line 14c. Gross Nonfarm Income ; Worksheet Instructions . Line 1b. Line 3c. Lines 3b and 4b. Line 4a. Line 4c. Worksheet for Figuring Net Earnings (Loss) From Self-Employment ; Credits . Low-Income Housing Credit ; Line 15a. PDF Self-employment Income Worksheet - Ndhfa Anticipated income for the next 12 months may be different. If the resident expects to earn less, obtain a written explanation why s/he expects to earn less. If it is anticipated to be more- include the higher amount. The amount on line 12, "Business income or (loss)" on form 1040 should equal "Net profit or (loss)" on Line 31 of SI 00820.210 How to Determine Net Earnings from Self-Employment (NESE) SI 00820.210 How to Determine Net Earnings from Self-Employment (NESE) A. Policy 1. Determining monthly NESE NESE is determined on a taxable year basis. The yearly NESE is divided equally among the months in the taxable year to get the NESE for each month. 2. Offsetting net loss

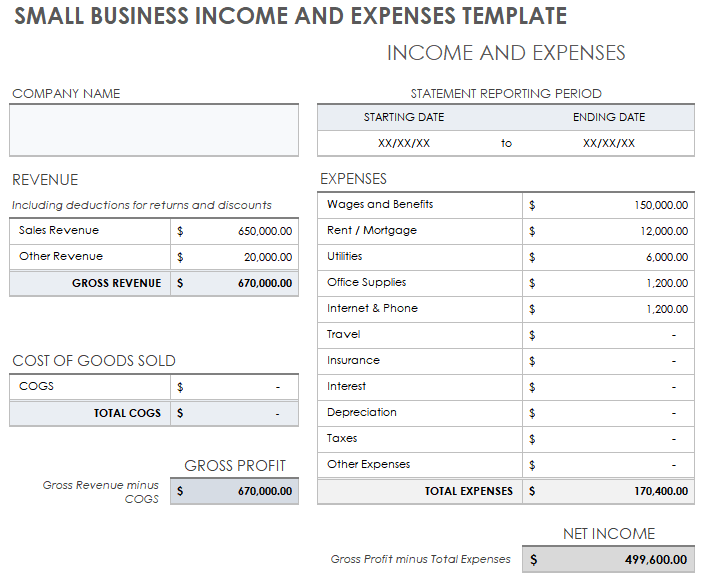

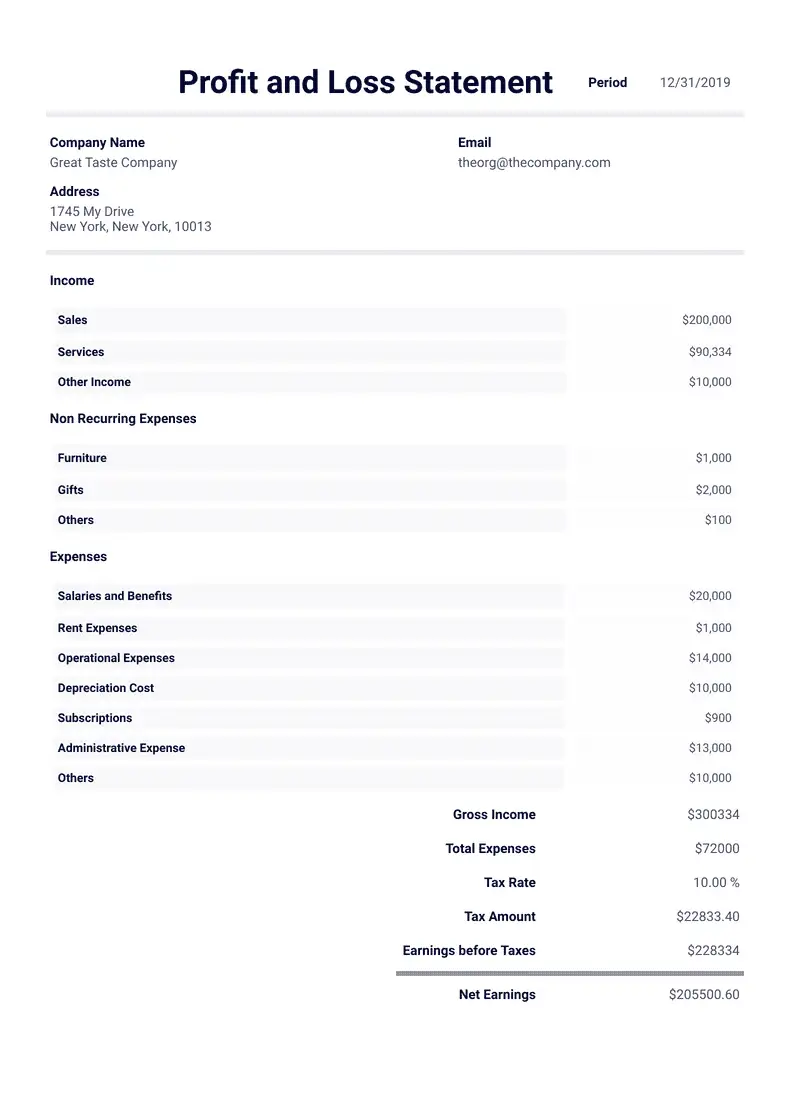

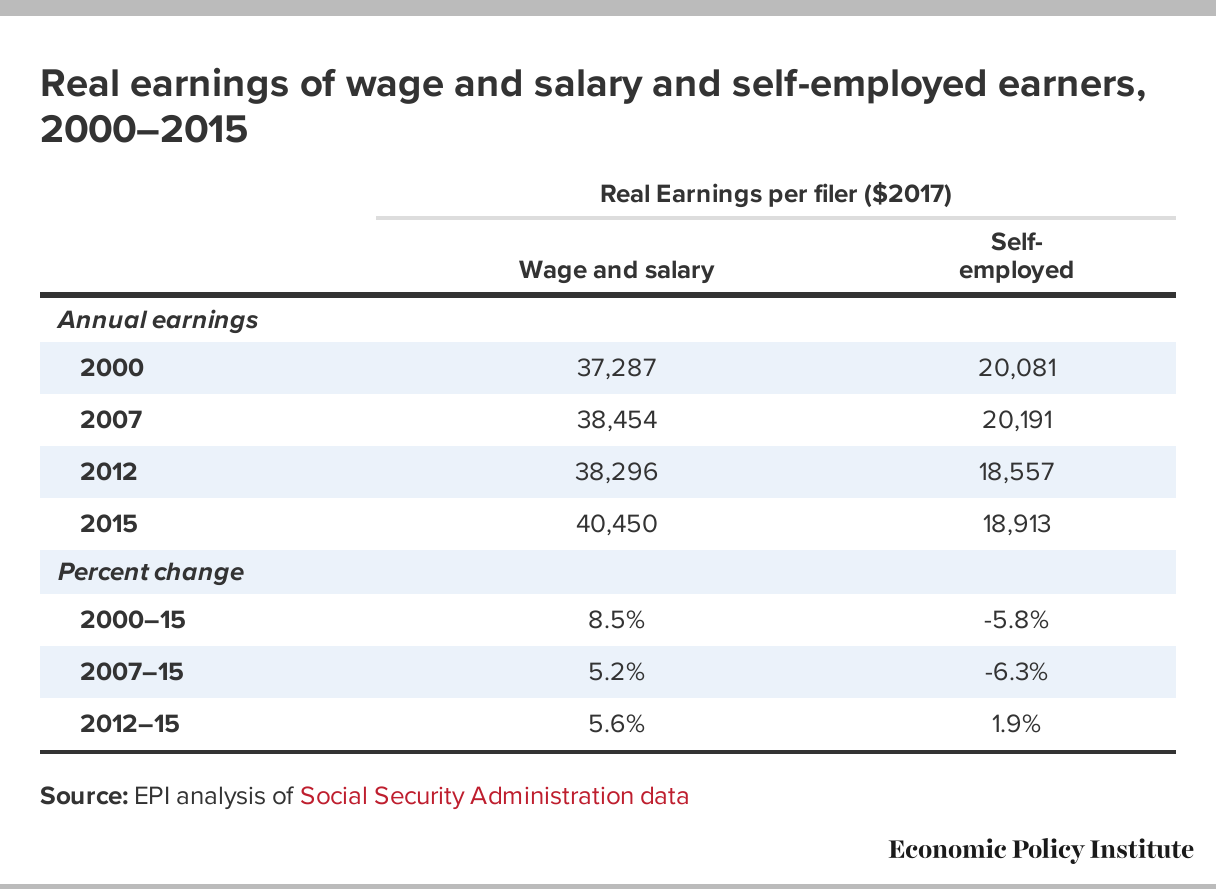

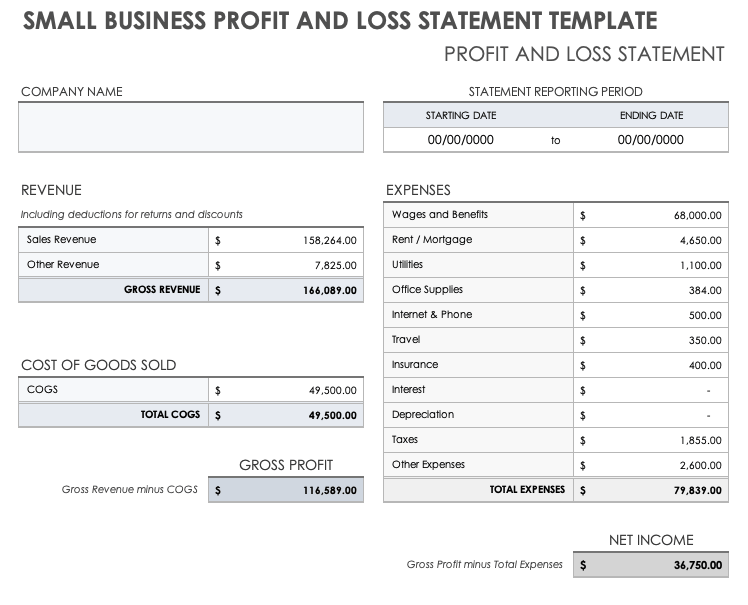

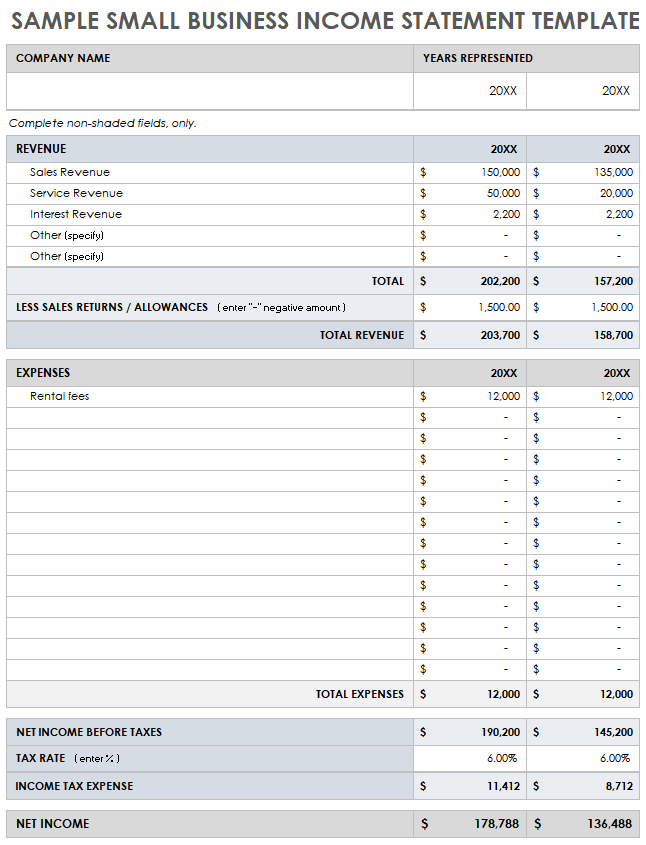

Simple Profit and Loss Statement for the Self-Employed Your 'net profit,' also known as 'bottom line earnings,' is found through the following formula: Net Profit = Gross Profit minus Operating Expenses minus Tax. You can see it calculated in this example: The net profit before taxes or 'taxable income,' in this example, is, $607. 5 look at the worksheet for figuring net earnings - Course Hero - In general, Line1, 3c, and 4 are involved in the calculation of Self-Employment income. Line 1---Ordinary business income (Loss) Line 3C---Other net rental income (Loss) Line 4---Guaranteed payments to partners - In a partner's self-employment income, the guaranteed payment included are payments to partners derived from a trade or business. How to Calculate Lost Earnings if You're Self Employed If you are a small business owner, documenting self-employment income to compute lost earnings can be complicated. Your business probably does not receive the income that gets reported in 1099 forms at the end of each year. This can make the income and expenses on Schedule D of your tax returns less informative for purposes of lost earnings. Schedule K Line 14a (Form 1065) Calculating Self-Employment Earnings Lacerte computes line 14a using the Worksheet for Figuring Net Earnings (Loss) From Self-Employment from page 41 of the 1065 form instructions. To generate Lacerte's version of the Self-Employment worksheet: Click on Settings. Click on Options. Select the Tax Return tab. Scroll down to the Federal Tax Options section.

Schedule K-1 (Form 1065) - Self-Employment Earnings (Loss) SELF-EMPLOYMENT EARNINGS (LOSS) Line 14A - Net Earnings (Loss) from Self-Employment - Amounts reported in Box 14, Code A represent the amount of net earnings from self-employment. For Limited Partners this amount generally includes any guaranteed payments received for services rendered to or on behalf of the partnership.

Understanding Schedule K-1 self-employment income for partners ... - Intuit The program creates a worksheet to show the calculation of net earnings from self-employment. Follow these steps to view the Self-Employment Worksheet: Go to the Forms tab. Select Worksheets from the left-side Form window. Select Self-Emp. Worksheet from the left-side Page window. How do I enter adjustments or overrides for self-employment income?

› publications › p54Publication 54 (2021), Tax Guide for U.S. Citizens and ... The self-employment tax is a social security and Medicare tax on net earnings from self-employment. You must pay self-employment tax if your net earnings from self-employment are at least $400. For 2021, the maximum amount of net earnings from self-employment that is subject to the social security portion of the tax is $142,800.

Self-Employed Individuals - Calculating Your Own Retirement-Plan ... You can use the Table and Worksheets for the Self-Employed (Publication 560) to find the reduced plan contribution rate to calculate the plan contribution and deduction for yourself. Deducting retirement plan contributions Total limits on plan contributions depend in part on your plan type. See the contribution limits for your plan.

SSA Handbook § 1200 - Social Security Administration To calculate the net earnings from self-employment, follow the steps below: Add up your total gross income as calculated under the income tax law. Include income from all your trades and businesses. Subtract all the deductions, including the allowances for depreciation that you are allowed when you calculate your income tax from the result in (A).

Profit and Loss Statement for Self Employed - Small Business Learning So, a profit and loss statement becomes critical — it's used to determine how much income was captured. Many self-employed individuals need to pay their taxes on a quarterly basis or pay additional fines and penalties. That means that a profit-and-loss statement should be produced at least every few months.

› publications › p17Publication 17 (2021), Your Federal Income Tax | Internal ... You must include income from services you performed as a minister when figuring your net earnings from self-employment, unless you have an exemption from self-employment tax. This also applies to Christian Science practitioners and members of a religious order who have not taken a vow of poverty. For more information, see Pub. 517.

Publication 587 (2021), Business Use of Your Home VerkkoIf you are claiming an increased standard deduction instead of itemizing your deductions, only use a net qualified disaster loss on line 15 of the worksheet version of Form 4684 for this Step 2. See the instructions for line 33, later, for the business use of the home casualty losses that you must include in Section B of the separate Form 4684 you …

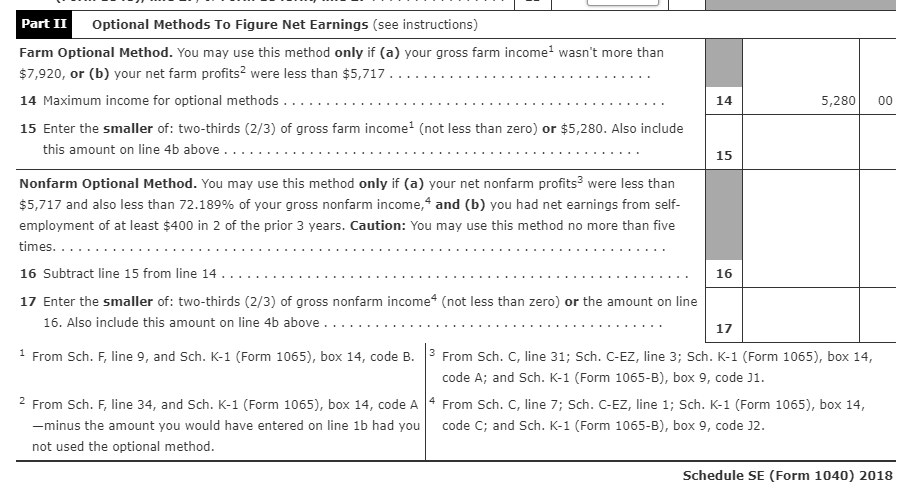

Net Earnings (Loss) Definition | Law Insider Worksheet for Figuring Net Earnings (Loss) From Self-Employment 1a Ordinary income (loss) (Schedule K, line 1) b Net income (loss) from certain rental real estate activities (see instructions) c Net income (loss) from other rental activities (Schedule K, line 3c) d Net loss from Form 4797, Part II, line 18, included on line 1a above.

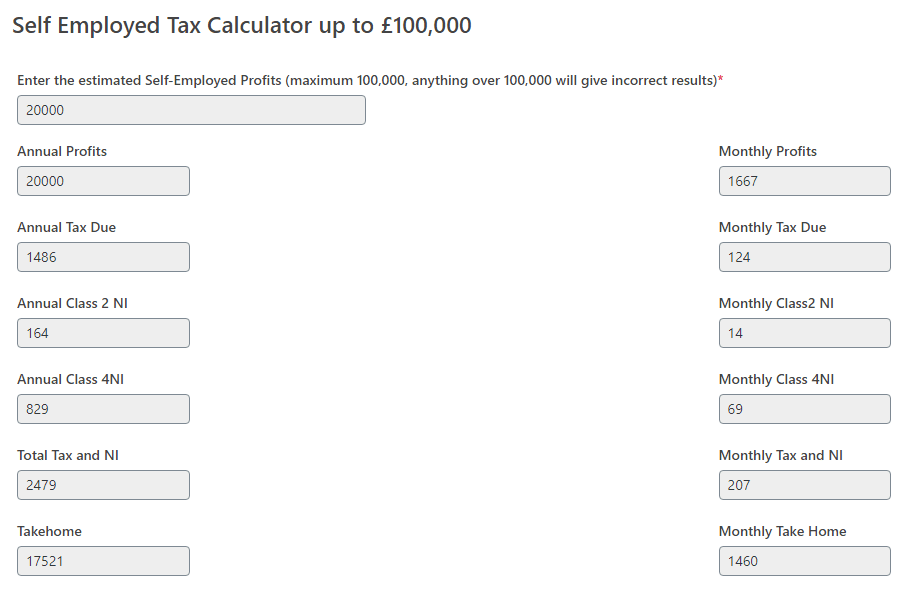

How to Calculate Self-Employment Income - Experian Calculating Your Income for a Mortgage Application. Mortgage lenders like to see stability—long employment histories and steady income. Most prefer to see at least two years of self-employment to show your ability to generate income over time. To calculate your monthly income for a mortgage application, start with this simple formula:

› publications › p535Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

5 Look at the Worksheet for Figuring Net Earnings Loss from Self ... Look at the Worksheet for Figuring Net Earnings (Loss) from Self-Employment(p. 35 for 2016) of the Form 1065 instructions. What lines from Schedule K are,in general, involved in the calculation of Self-Employment income? Line 1, 3c,and 4What guaranteed payments are included in a partner's self-employmentincome?

Calculating Your Net Earnings From Self-Employment You must complete the following federal tax forms by April 15 following any year in which you have net earnings of $400 or more: Form 1040 (U.S. Individual Income Tax Return). Schedule C (Profit or Loss from Business) or Schedule F (Profit or Loss from Farming) as appropriate. Schedule SE (Self-Employment Tax).

PDF FHA Self-Employment Income Calculation Worksheet Job Aid The FHA Self-Employment Income Calculation Worksheet, which is located at . wholesale.franklinamerican.com under Forms > FHA, is a tool to be used for FHA loans when any borrower is self -employed. • The worksheet is to be used for evaluation of only one self-employment business per borrower. • A new worksheet will need to be used for ...

Impact of Self-Employment Loss on Earned Income - Journal of Accountancy The worksheet says, "Generally, your earned income is the total of the amounts reported on form 1040, lines 7 (wages), 12 (business income or loss), and 18 (farm income or loss) minus the amount, if any, on line 27 (self-employment tax deduction).". In Allyson Christina Briggs v. Commissioner, TC summary opinion 2004-22, the issue for the ...

› publications › p590aPublication 590-A (2021), Contributions to Individual ... Tom can take a deduction of only $5,850. Using Worksheet 1-2, Figuring Your Reduced IRA Deduction for 2021, Tom figures his deductible and nondeductible amounts as shown on Worksheet 1-2. Figuring Your Reduced IRA Deduction for 2021—Example 1 Illustrated. He can choose to treat the $5,850 as either deductible or nondeductible contributions.

Net Earnings from Self-Employment - SocialSecurityHop.com Net earnings also include any ordinary income or loss from partnerships. If any part of your income is included in gross earnings from self-employment, expenses connected with this income cannot be deducted. 1200.2 Are there other ways of calculating net earnings from self-employment? Under certain circumstances, optional methods of computing ...

Publication 590-A (2021), Contributions to Individual Retirement ... VerkkoCompensation includes earnings from self-employment even if they aren’t subject to self-employment tax because of your religious beliefs. Self-employment loss. If you have a net loss from self-employment, ... Using Worksheet 1-2, Figuring Your Reduced IRA Deduction for 2021, ...

How To Calculate Net Earnings (loss) From Self-employment Calculate net earnings from self employment. You can't simply multiply your net profit on schedule c by 10%. To do this, multiply the net income by 92.35 percent. Find your net profit before taking exemptions or paying taxes (from schedule c of your tax return) for the two most recent years you filed taxes. You must use form 1040 for your tax ...

1040 (2021) | Internal Revenue Service - IRS tax forms VerkkoSee the instructions for line 30 and the Recovery Rebate Credit Worksheet to figure your credit amount. Standard deduction amount increased. ... You had net earnings from self-employment of at least $400. 4. ... The only exception is for purposes of figuring your self-employment tax.

Publication 535 (2021), Business Expenses | Internal Revenue … VerkkoComments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Publication 575 (2021), Pension and Annuity Income VerkkoForm 8915-F replaces Form 8915-E. Form 8915-F, Qualified Disaster Retirement Plan Distributions and Repayments, replaces Form 8915-E for reporting qualified 2020 disaster distributions and repayments of those distributions made in 2021 and 2022, as applicable.In previous years, distributions and repayments would be reported on the …

› publications › p560Publication 560 (2021), Retirement Plans for Small Business Distributions of other income or loss to limited partners aren't net earnings from self-employment. For SIMPLE plans, net earnings from self-employment are the amount on line 4 Schedule SE (Form 1040), Self-Employment Tax, before subtracting any contributions made to the SIMPLE plan for yourself.

How To Calculate Self Employment Income for a Mortgage | 2022 To get approved, you'll need: A FICO score of at least 580. A debt-to-income ratio below 50 percent. A 3.5% down payment. It's possible to find an FHA lender willing to approve a loan even if your credit score falls as low as 500, but the lender would require a 10 percent down payment instead of the usual 3.5 percent.

Publication 560 (2021), Retirement Plans for Small Business VerkkoDistributions of other income or loss to limited partners aren't net earnings from self-employment. For SIMPLE plans, net earnings from self-employment are the amount on line 4 Schedule SE (Form 1040), Self-Employment Tax, before subtracting any contributions made to the SIMPLE plan for yourself.

Calculating Net Earnings for Business Taxes - The Balance Small Business Calculating Net Earnings for Self-employment Taxes The net earnings total forms the basis for calculating self-employment taxes on Schedule SE. Some income does not count for Social Security and should not be included in figuring your net earnings: Dividend income: unless it is received as a dealer in stocks and securities

Publication 502 (2021), Medical and Dental Expenses Verkko13.1.2022 · Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Publication 17 (2021), Your Federal Income Tax - IRS tax forms VerkkoYou must include income from services you performed as a minister when figuring your net earnings from self-employment, unless you have an exemption from self-employment tax. This also applies to Christian Science practitioners and members of a religious order who have not taken a vow of poverty. For more information, see Pub. 517.

![How to Prepare a Profit and Loss Statement [Free Template]](https://assets-blog.fundera.com/assets/wp-content/uploads/2019/05/22094451/profit-and-loss-statement.jpg)

0 Response to "41 worksheet for figuring net earnings loss from self employment"

Post a Comment