43 convert accrual to cash basis worksheet

› instructions › i1116Instructions for Form 1116 (2021) | Internal Revenue Service Before you complete Worksheet A or Worksheet B, you must reduce each foreign source long-term capital gain by the amount of that gain you elected to include on Form 4952, line 4g. The gain you elected to include on Form 4952, line 4g, must be entered directly on line 1a of the applicable Form 1116 without adjustment.. › articles › how-to-convertHow to convert accrual basis to cash basis accounting ... May 21, 2022 · To convert from accrual basis to cash basis accounting, follow these steps: Subtract accrued expenses . If an expense has been accrued because there is no supplier invoice for it, remove it from the financial statements.

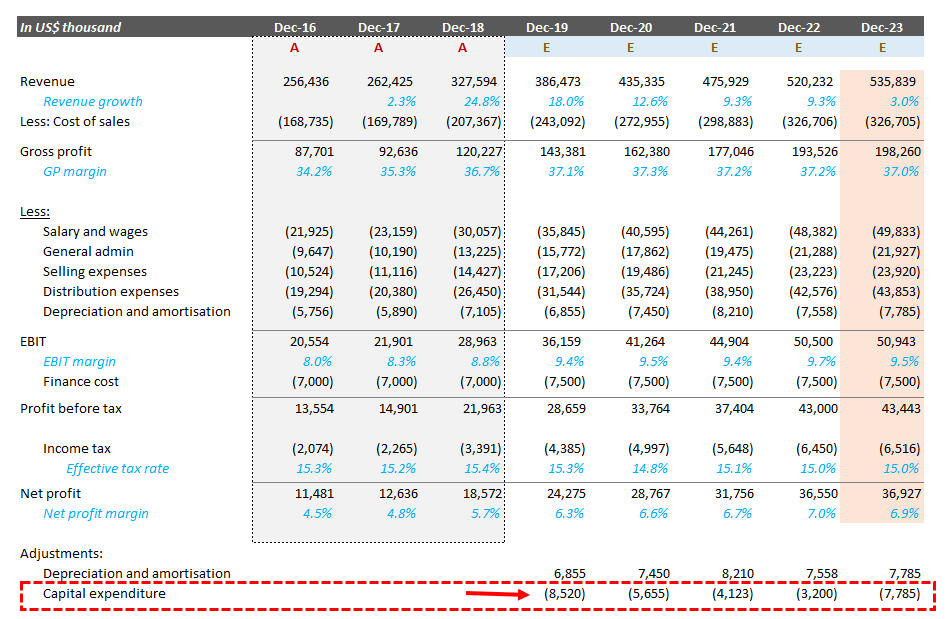

Financial Forecasting In Accounting Explained | Wafeq If you do not have access to Excel, you will still be able to open the spreadsheet. We would advise making a fresh forecast every month (or perhaps weekly, if money is tight) and testing the accuracy of your forecasts on a frequent basis so that you may get better at estimating your cash flow over time.

Convert accrual to cash basis worksheet

Calculating U.S. Treasury Pricing - CME Group Cash Treasuries and futures based on U.S. Treasuries trade in points and fractions of points (1/32). But when doing any mathematical calculations, we must first convert from 1/32 to decimal, do the calculation, then convert back to 1/32 price convention. Test Your Knowledge Notes and Bonds are priced in fractions not decimals True False Inventoriable Items Treated as Nonincidental Materials and Supplies ... A qualifying small business taxpayer may determine the amount of the allowable deduction for inventoriable items treated as nonincidental materials and supplies by using one of the following methods (LIFO may NOT be used): A first-in-first-out (FIFO) method An average cost method A specific identification method Avoid costly penalties! Budget Cycle - MOF KSA's development of the accounting system of transition from cash basis to accounting accrual basis has led to greater transparency and accountability in line with G-20 countries. Saudi Vision 2030 has launched twelve operational programs to implement the budget.

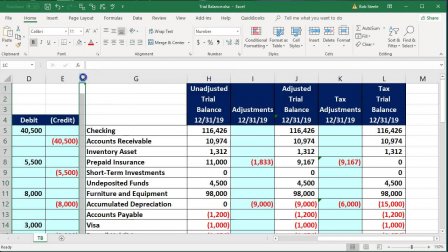

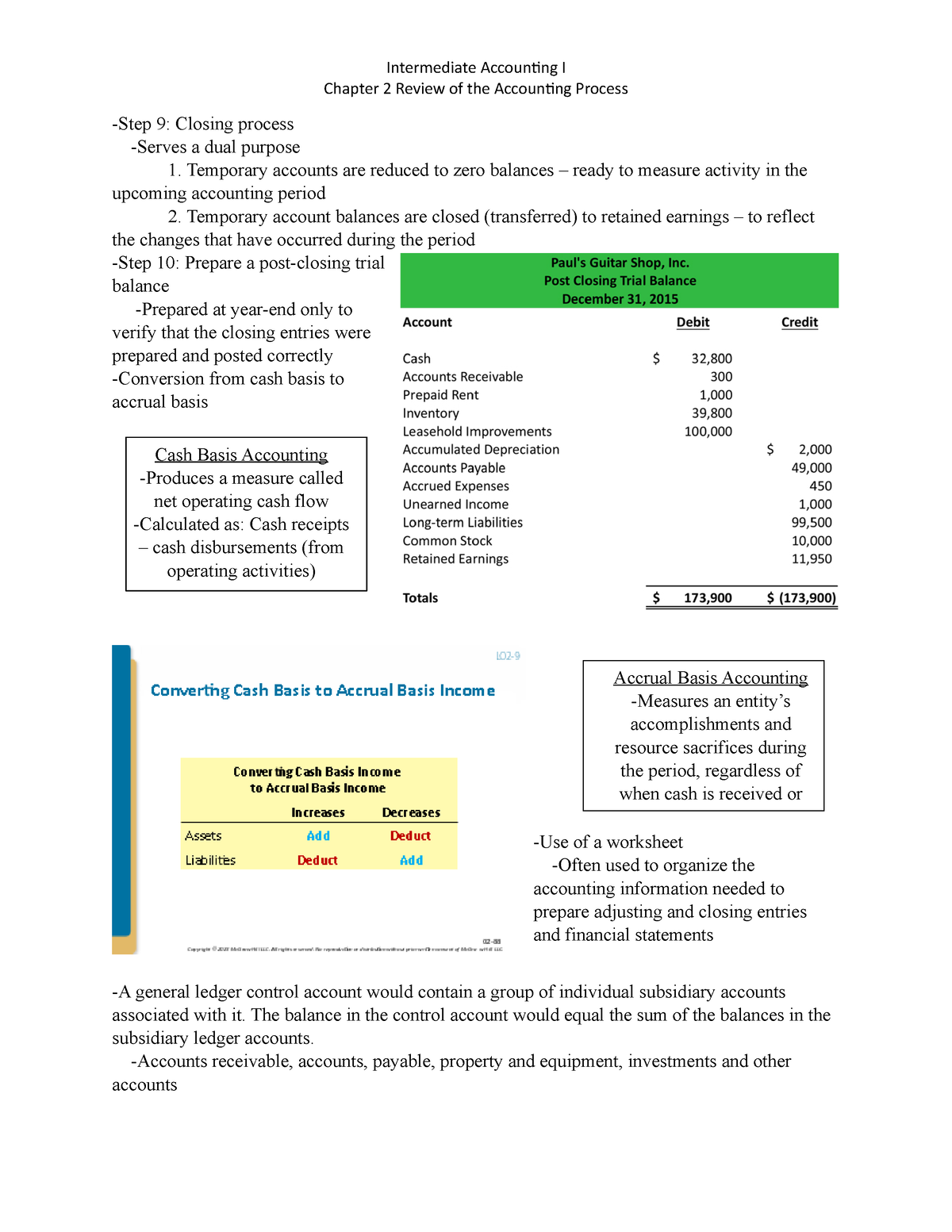

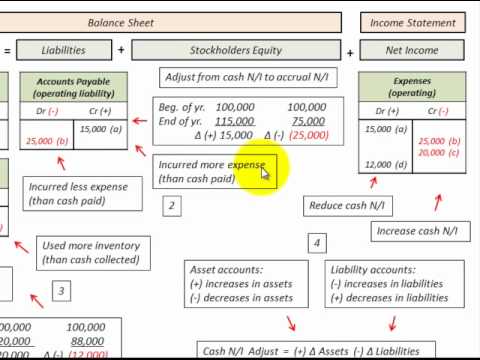

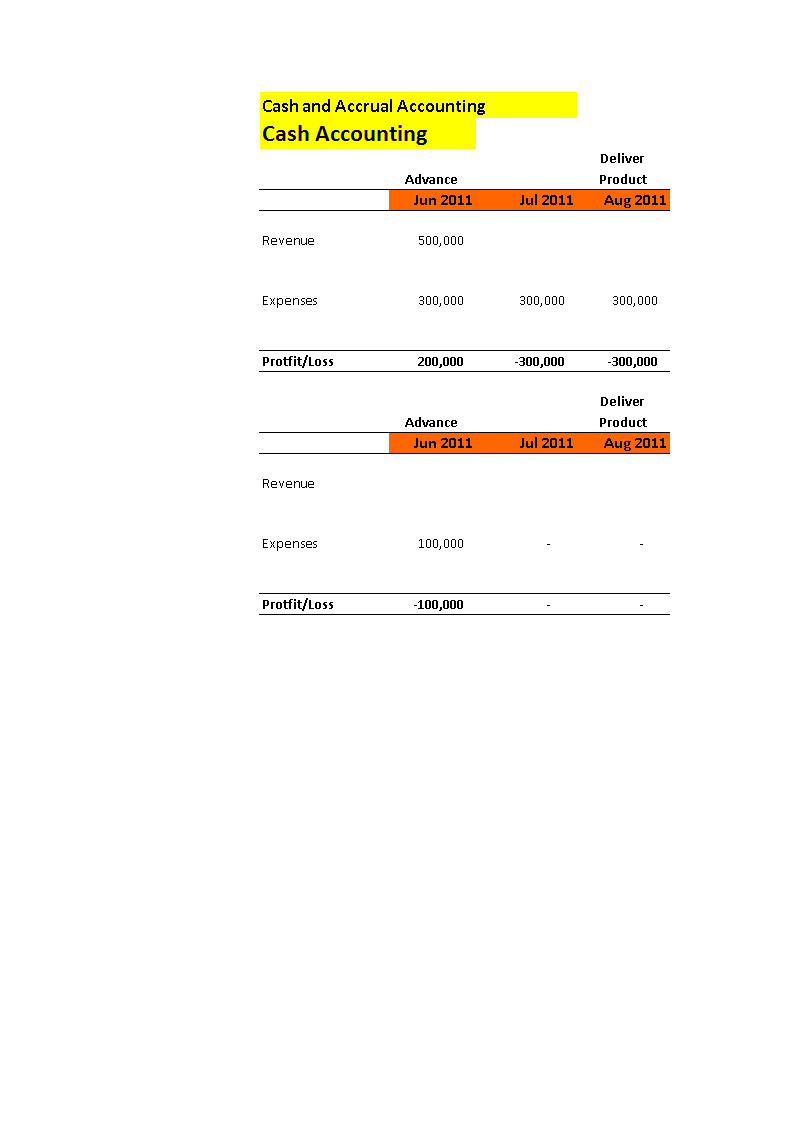

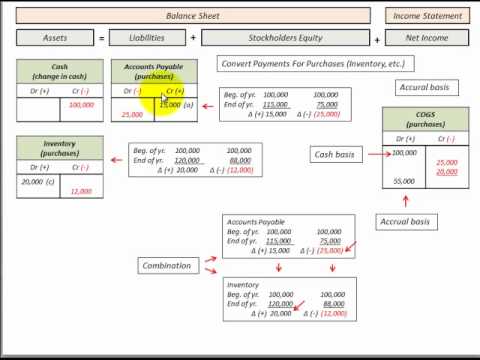

Convert accrual to cash basis worksheet. Accounting-Financial Accounting Total-Beginners to Advanced We can think of the statement of cash flows as converting the accrual basis to a cash basis. We can use two methods when constructing the operating section of the statement of cash flows, the direct method, and the indirect method. The indirect method is more common and often required, even if we also add the direct method. assignmentessays.comAssignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. Continuation of Coverage after Retirement - U.S. Office of Personnel ... Option A is free the month after you reach age 65 or retire (if later). It is free but reductions begin. Your Option A-standard coverage will reduce by 2% of the pre-retirement amount per month ($200.00) until it reaches 25% ($2500.00) of the pre-retirement amount. Change to the cost of your Option B - Additional Insurance over time. learn.microsoft.com › en-us › dynamics-gpGeneral Ledger - Dynamics GP | Microsoft Learn A reversing transaction reverses the distributions—debit and credit entries—of a previous transaction. Generally speaking, entries that involve the accrual of assets (such as unbilled revenues) or the accrual of liabilities (such as salaries) might be reversed because they result in a future cash receipt or payment.

Rubino & Company Tax Senior in Vienna, VA | 804564204 | Snagajob · Participate in tax consulting engagements addressing various areas such as converting S corporations and LLCs to C corporations, cash to accrual adjustments and R&D tax credits. · Provide responsive, high-quality tax services to clients and provide leadership to and development of tax staff. Taxpayers Allowed to Use the Cash Method - Loopholelewy.com If you operate a custom manufacturing business with average annual gross receipts of $10 million or less for the three previous years, you can use the cash method. The cost of materials and supplies used in the performance of the service must be deducted when: Provided to customers or When you pay for them, Whichever is later. 5 Steps to Simplify Your BigCommerce Accounting Here are five steps to simplify your Bigcommerce accounting and bookkeeping. Step 1: Switch to accrual accounting Depending on the type of business you have, you will either need accrual accounting or cash accounting. Online merchants are better off using accrual accounting than the cash method. Note X - Pensions - Defined Benefit Plans - No Qualifying Trust ... If the pension plan is closed to new entrants, that fact should be disclosed. c) The number of employees covered by the benefit terms, separately identifying numbers of the following: (1) Inactive employees (or their beneficiaries) currently receiving benefits (2) Inactive employees entitled to but not yet receiving benefits (3) Active employees.

› playstation-userbasePlayStation userbase "significantly larger" than Xbox even if ... Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ... Exchange Rate British Pound to US Dollar (Currency Calculator) - X-Rates Exchange Rate British Pound to US Dollar. 1.00 GBP = 1.225568 USD. Dec 15, 2022 15:16 UTC. View GBP Rates Table. View USD Rates Table. View GBP / USD Graphs. 1. Configure Converter. . Bitcoin and Crypto Calculator - Convert BTC and crypto into any World ... Leader in cryptocurrency, Bitcoin, Ethereum, XRP, blockchain, DeFi, digital finance and Web 3.0 news with analysis, video and live price updates. Currency Conversion Calculator | Currency Converter - Forbes Advisor How Does a Currency Conversion Calculator Work? Our currency conversion calculator uses the current exchange rate to determine how much your money is worth in a different currency. Since this...

bench.co › blog › accountingCash Basis Accounting vs. Accrual Accounting - Bench Jul 10, 2021 · Using cash basis accounting, income is recorded when you receive it, whereas with the accrual method, income is recorded when you earn it. Following the above example, using accrual accounting , if you invoice a client for $5,000 in December of 2017, you would record that transaction as a part of your 2017 income (and thus pay taxes on it ...

The leading online publication for the accounting profession ... Making tax digital. Making Tax Digital (MTD) is a UK government initiative to digitise the tax system. April 2022 will see the extension of MTD for VAT and April 2024 sees the implementation of MTD for income tax self assessment (MTD for ITSA) for landlords or the self-employed with turnover of at least £10,000. Read more Making tax digital.

Accrued Interest: Definition and How to Calculate | The Motley Fool To do this, you'll need to figure out the monthly interest owed and multiply it by two. The formula is $10,000 x .05 / 12 = $41.67. This means you have $83.33 of accrued interest. Make sure when...

Guaranteed minimum pension (GMP) - abrdn If the member retires more than seven weeks later than their 60th birthday (women) / 65th birthday (men), their accrued GMP must be increased by at least 1/7% for each complete week thereafter. Increases in payment GMP increases can sometimes be provided by the scheme, the State or a combination of the two. Increases provided by the scheme

Other Postemployment Benefit (OPEB) Plan Schedules - Office of the ... The amount of contributions recognized by the OPEB plan in relation to the actuarially determined contribution of the employer as a percentage of covered-employee payroll. If an actuarially determined contribution is not calculated and the contribution requirements of the employer are statutorily or contractually established: a.

Manual Journals in Xero - Xero TV The easy peasy kid's guide to small business cash flow 1:10. Direct Bank Feeds in Xero 1:17. Add a Xero to your bottom line 2:26. New invoicing in Xero 1:43. Xero for iOS - Invoicing Update 1:07. Search in Xero 2:05. One More Day Currently loaded videos are 1 ...

2022 Year-End Tax Planning Guide - Lexology 117. Take advantage of high exclusions. As discussed above, the annual gift tax exclusion will increase to $16,000 for 2022 and will further increase to $17,000 in 2023. The estate and gift tax ...

Gold Price Calculator (Gram, KG, Oz, Tola) - Gold Calculator 1. Select a unit type of gold from the dropdown list shown in the image above. You can choose different units from the list which are famous around the globe. They are Gram, Ounce, Tola, Kilo, Tael, Masha, Bhori or Vori, Grain, etc. There two types of tola; they are slightly different in weight. 2. Enter the number of units.

Exchange Rate US Dollar to Canadian Dollar (Currency Calculator) - X-Rates Exchange Rate US Dollar to Canadian Dollar 1.00 USD = 1.374307 CAD Dec 17, 2022 12:25 UTC View USD Rates Table View CAD Rates Table View USD / CAD Graphs 1. Configure Converter ↔ Currency Calculator Graphs Rates Table Monthly Average Historic Lookup Change Currency Calculator base currency Argentine Peso Australian Dollar Bahraini Dinar

› publications › p514Publication 514 (2021), Foreign Tax Credit for Individuals Accrual method of accounting. If you use an accrual method of accounting, you can claim the credit only in the year in which you accrue the tax. You are using an accrual method of accounting if you report income when you earn it, rather than when you receive it, and you deduct your expenses when you incur them, rather than when you pay them.

Convert USD to CAD How to Convert USD to CAD. 1 United States Dollar = 1.367064 Canadian Dollar. 1 Canadian Dollar = 0.7314946484 United States Dollar. Example: convert 15 United States Dollar to Canadian Dollar: 15 United States Dollar = 15 × 1.367064 Canadian Dollar = 20.50596 Canadian Dollar.

Agreement of balances guidance 2022 to 2023 - GOV.UK Mismatch reports consist of 2 worksheets that show the same information in 2 formats (purely presentational), and show differences between the notified, adjusted, accrued and disputed amounts.

USD To EUR: Convert United States Dollar to Euro - Forbes 1 USD To EUR Convert United States Dollar To Euro 1 USD = 0.94353 EUR Dec 17, 2022 09:05 UTC Send Money Check the currency rates against all the world currencies here. The currency converter...

Convert Canadian Dollar to United States Dollar | CAD to USD Currency ... Convert Canadian Dollar to United States Dollar | CAD to USD Currency Converter Currency Converter CAD Exchange Rates CAD 1.00 = 0.737 USD invert currencies CAD - Canadian Dollar USD - United States Dollar Conversion Rate (Buy/Sell) USD/CAD = 0.73664146 Last Updated 12/15/2022 2:23:06 AM en-US CAD Canadian Dollar Country Canada Region North America

Convert from United States Dollar (USD) to Euro (EUR) Convert United States Dollar to Euro | USD to EUR Currency Converter USD 1.00 = 0.939 EUR invert currencies USD - United States Dollar EUR - Euro Conversion Rate (Buy/Sell) EUR/USD = 0.93948319 Last Updated 12/16/2022 6:59:58 AM en-US USD US Dollar Country United States of America Region North America Sub-Unit 1 Dollar = 100 cents Symbol US$

Basis Cash Price in USD: Convert BAC to USD Today - CoinGecko BAC to USD rate today is $0.00378574 and has decreased -2.7% from $0.003890211094 since yesterday. Basis Cash (BAC) is on a downward monthly trajectory as it has decreased -12.1% from $0.004305021063 since 1 month (30 days) ago. Price. Market Cap. 24h 7d 14d 30d 90d 180d 1y Max.

Simple vs. Compound Interest | The Motley Fool Simple interest is calculated, rather simply, on an annual basis as a percentage of the principal amount. You can compute simple interest by multiplying the principal amount by the annual...

Budget Cycle - MOF KSA's development of the accounting system of transition from cash basis to accounting accrual basis has led to greater transparency and accountability in line with G-20 countries. Saudi Vision 2030 has launched twelve operational programs to implement the budget.

Inventoriable Items Treated as Nonincidental Materials and Supplies ... A qualifying small business taxpayer may determine the amount of the allowable deduction for inventoriable items treated as nonincidental materials and supplies by using one of the following methods (LIFO may NOT be used): A first-in-first-out (FIFO) method An average cost method A specific identification method Avoid costly penalties!

Calculating U.S. Treasury Pricing - CME Group Cash Treasuries and futures based on U.S. Treasuries trade in points and fractions of points (1/32). But when doing any mathematical calculations, we must first convert from 1/32 to decimal, do the calculation, then convert back to 1/32 price convention. Test Your Knowledge Notes and Bonds are priced in fractions not decimals True False

![Solved] City of Happyday Statement of Net Positio | SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2020/08/5f463cdfd894a_1598438600170.jpg)

0 Response to "43 convert accrual to cash basis worksheet"

Post a Comment