44 child tax credit worksheet 2016

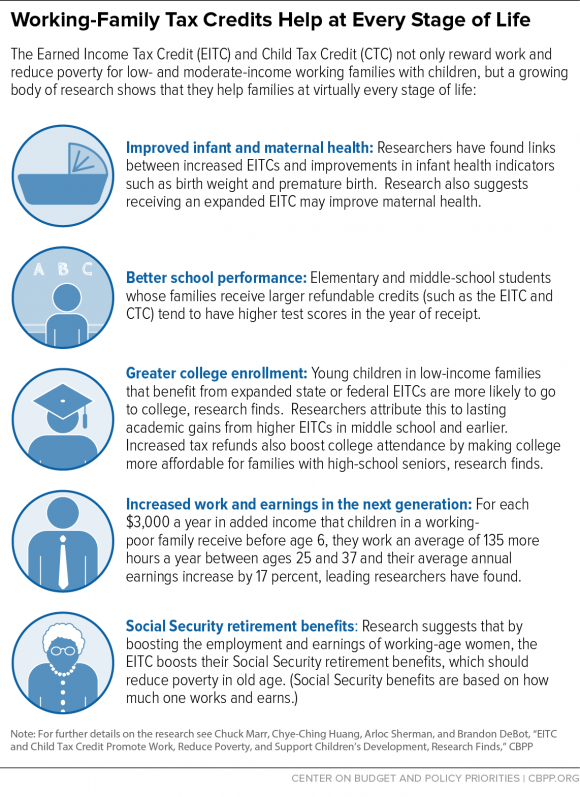

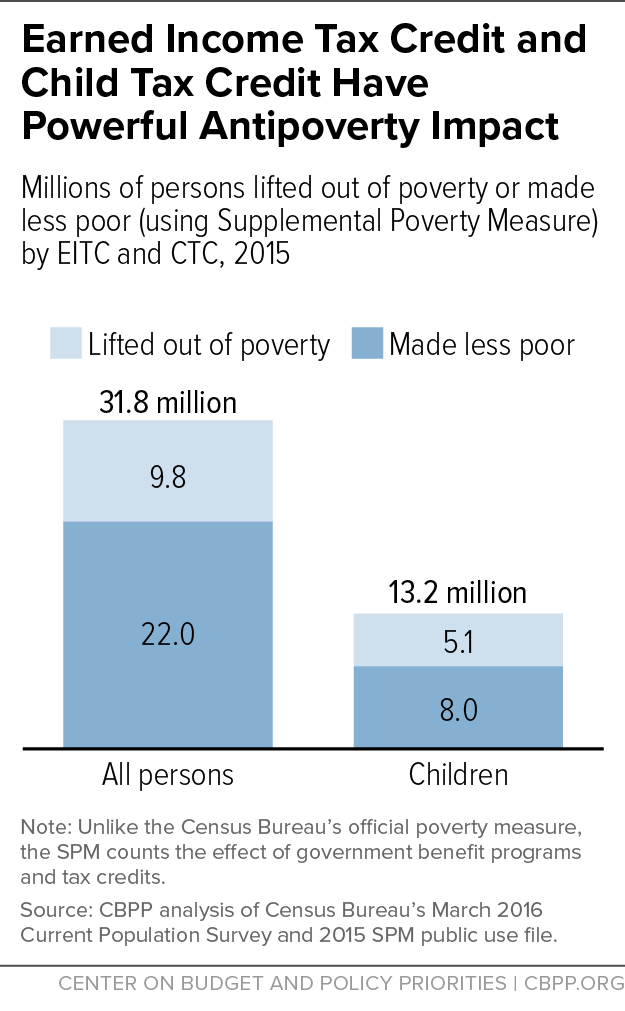

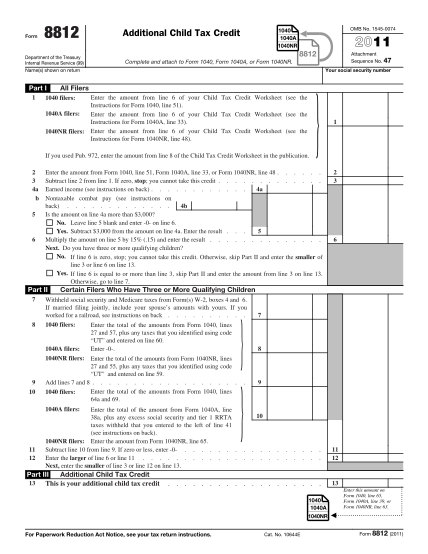

Additional Child Tax Credit (ACTC): Definition and Who Qualifies The additional child tax credit was the refundable portion of the child tax credit. · It could be claimed by families who owed the IRS less than their qualified ... California Earned Income Tax Credit and Young Child Tax Credit Apr 28, 2022 ... This credit gives you a refund or reduces your tax owed. If you qualify for CalEITC and have a child under the age of 6, you may also qualify ...

› pub › irs-pdf8867 Paid Preparer’s Due Diligence Checklist - IRS tax forms applicable worksheet(s), a record of how, when, and from whom the information used to prepare Form 8867 and any applicable worksheet(s) was obtained, and a copy of any document(s) provided by the taxpayer that you relied on to determine eligibility for the credit(s) and/or HOH filing status or to figure

Child tax credit worksheet 2016

2021 Child Tax Credit Top 7 Requirements & Tax Calculator Dec 1, 2022 ... The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements: 1. age, 2. relationship, 3. support, ... › instructions › i5695Instructions for Form 5695 (2020) | Internal Revenue Service If you are claiming the child tax credit or the credit for other dependents for 2020, the amount you enter on line 4 of the worksheet depends on whether you are filing Form 2555. If you are filing Form 2555, enter the amount, if any, from line 16 of the Child Tax Credit and Credit for Other Dependents Worksheet in Pub. 972. mobiri.seMake Website for Free w/o Coding Start creating amazing mobile-ready and uber-fast websites. Drag-n-drop only, no coding. 4000+ site blocks. Free for any use. Easy website maker.

Child tax credit worksheet 2016. › publications › p972Publication 972 (2020), Child Tax Credit and Credit for Other ... Summary: This is the Line 14 Worksheet used to determine the amount to be entered on line 14 of the Child Tax Credit and Credit for Other Dependents Worksheet. Before you begin: Complete the Earned Income Worksheet, later in this publication, 1040 and 1040-SR filers. › publications › p969Publication 969 (2021), Health Savings Accounts and Other Tax ... Advance child tax credit payments. From July through December 2021, advance payments were sent automatically to taxpayers with qualifying children who met certain criteria. The advance child tax credit payments were early payments of up to 50% of the estimated child tax credit that taxpayers may properly claim on their 2021 returns. How do I calculate the Child Tax Credit? - TaxSlayer Support Who can be considered a Qualifying Child? · You must have at least $2,500 in earned income on your return to claim the credit · Limited to tax liability (May ... 2016 Schedule 8812 (Form 1040A or 1040) - IRS If you file Form 2555 or 2555-EZ stop here; you cannot claim the additional child tax credit. If you are required to use the worksheet in Pub. 972, enter the ...

› instructions › i8839Instructions for Form 8839 (2021) | Internal Revenue Service Did you use the Adoption Credit Carryforward Worksheet—Line 16 in the 2020 Form 8839 instructions? No. Skip lines 2 through 6. Enter the amount from line 1 of this worksheet on line 7. Yes. Have that worksheet handy and go to line 2. 2. Enter any 2016 credit carryforward (line 12 of your 2020 worksheet) 2. _____ 3. Schedule 8812 (Form 1040A or 1040) 2016 (Form 1040A or 1040). CAUTION. Child Tax Credit. 2016 ! SCHEDULE 8812 ... Enter the amount from line 6 of your Child Tax Credit Worksheet (see the. Earned Income Tax Credit for DC | otr - DC.gov Taxpayers without a qualifying child must use the DC Earned Income Tax Credit (EITC) Worksheet for Filers Without a Qualifying Child on page 12 to determine ... › publications › p936Publication 936 (2021), Home Mortgage Interest Deduction Advance child tax credit payments. From July through December 2021, advance payments were sent automatically to taxpayers with qualifying children who met certain criteria. The advance child tax credit payments were early payments of up to 50% of the estimated child tax credit that taxpayers may properly claim on their 2021 returns.

2016 Instruction 1040A - Centro Latino de Capacitacion 2016 Child Tax Credit Worksheet—Line 35. • Single, head of household, or qualifying widow(er) — $75,000. Keep for Your Records. 1. To be a qualifying child ... Child Tax Credit - IRS Dec 20, 2016 ... If you do not have a qualifying child, you cannot claim the child tax credit. Publication 972 (2016). Page 5. Page 6. Child Tax Credit Worksheet ... Earned Income Credit EIC 2016 Notice to Employees of Federal. Earned Income Tax Credit (EIC). If you make $47,000* or less, your employer should notify you at the time of. mobiri.seMake Website for Free w/o Coding Start creating amazing mobile-ready and uber-fast websites. Drag-n-drop only, no coding. 4000+ site blocks. Free for any use. Easy website maker.

› instructions › i5695Instructions for Form 5695 (2020) | Internal Revenue Service If you are claiming the child tax credit or the credit for other dependents for 2020, the amount you enter on line 4 of the worksheet depends on whether you are filing Form 2555. If you are filing Form 2555, enter the amount, if any, from line 16 of the Child Tax Credit and Credit for Other Dependents Worksheet in Pub. 972.

2021 Child Tax Credit Top 7 Requirements & Tax Calculator Dec 1, 2022 ... The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements: 1. age, 2. relationship, 3. support, ...

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-06.jpg)

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-03.jpg)

0 Response to "44 child tax credit worksheet 2016"

Post a Comment