45 calculating sales tax worksheet

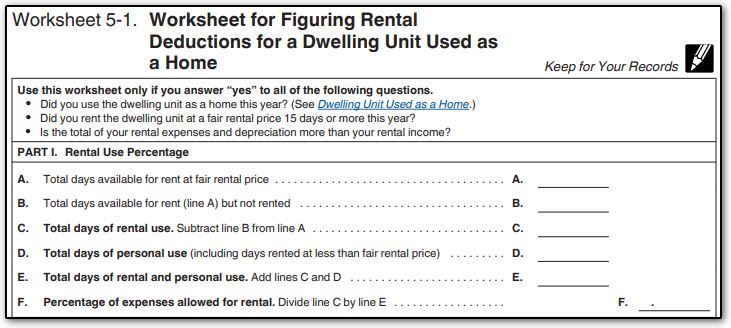

Is there a way to figure out what method IRS used to calculate tax in ... The code 150 is your original tax. Code 290 is the added tax. When you add them together it should equal your new total tax. On the 1040x it is line 11. The Schedule D by itself does not calculate the tax. You use a tax worksheet if the income qualifies. comptroller.texas.gov › taxes › property-taxTax Rate Calculation - Texas Comptroller of Public Accounts Calculating the voter-approval tax rate after the first year, however, uses the last year's sales tax revenue in calculating the M&O component of the voter-approval tax rate. The taxing unit subtracts a sales tax adjustment rate. 77 [See Tax Rate Calculation Example 9 (PDF)] Sales Tax in the No-New-Revenue M&O Rate

Per Diem Rates | GSA Web14/11/2022 · Per OMB Circular A-123, federal travelers "...must provide a tax exemption certificate to lodging vendors, when applicable, to exclude state and local taxes from their hotel bills." GSA's SmartPay team maintains the most current state tax information, including any applicable forms. Last Reviewed: 2022-11-14 . Home Resources for… Americans …

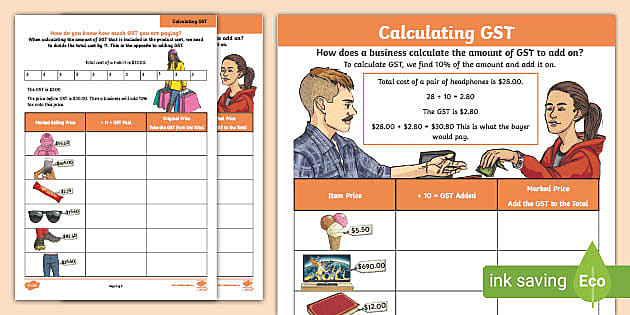

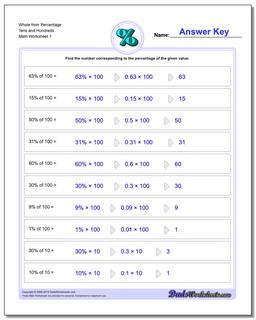

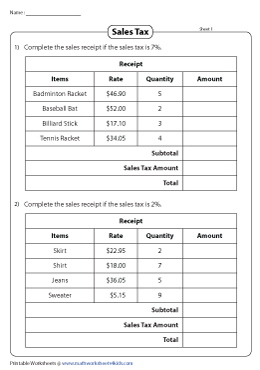

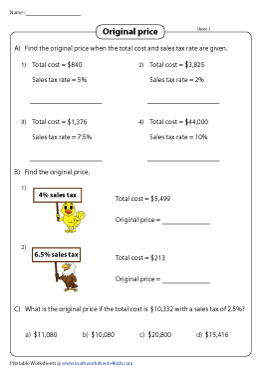

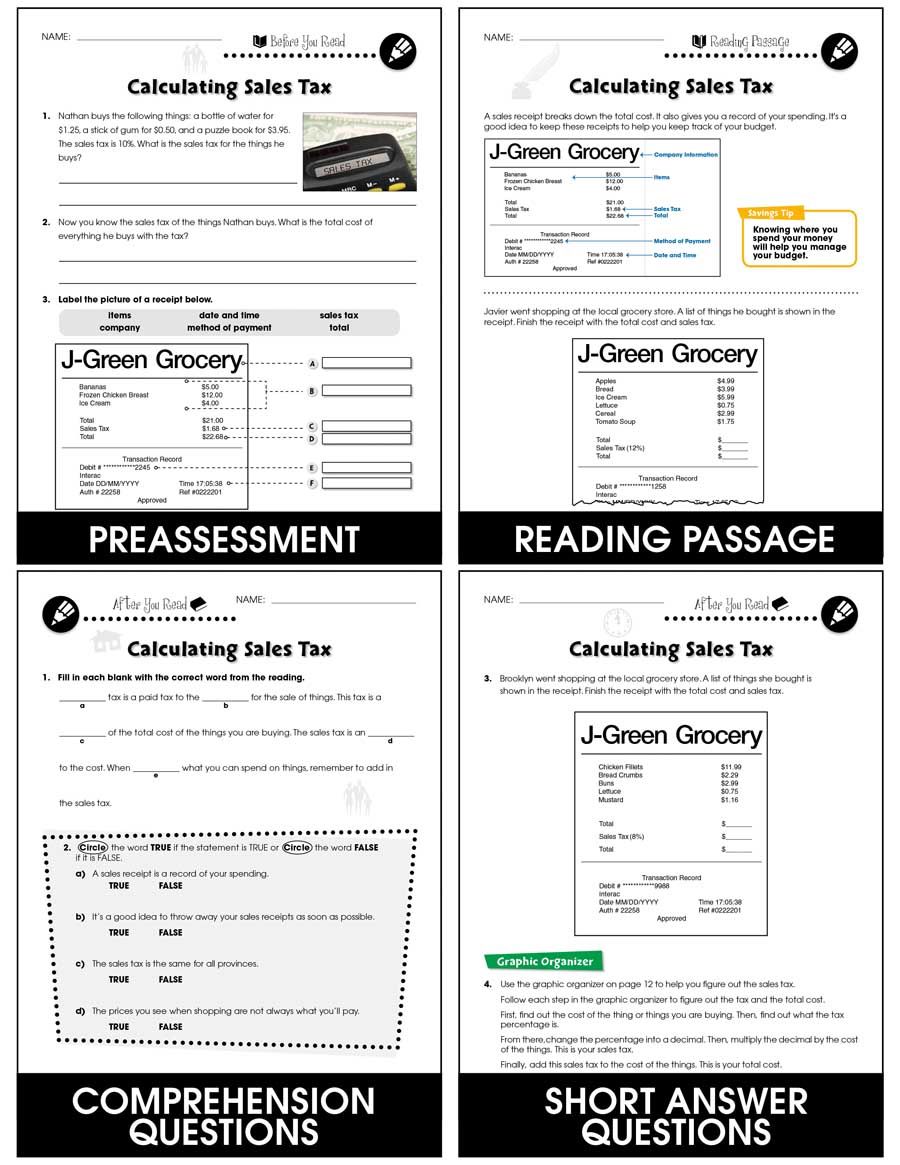

Calculating sales tax worksheet

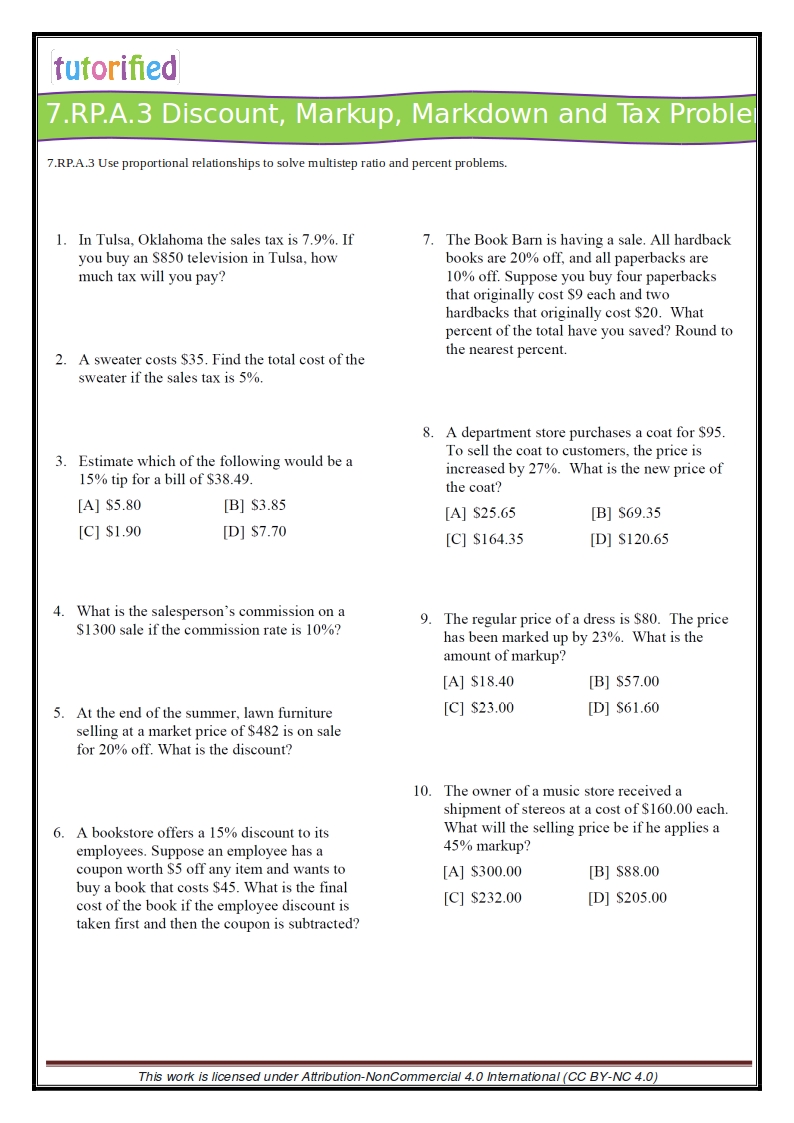

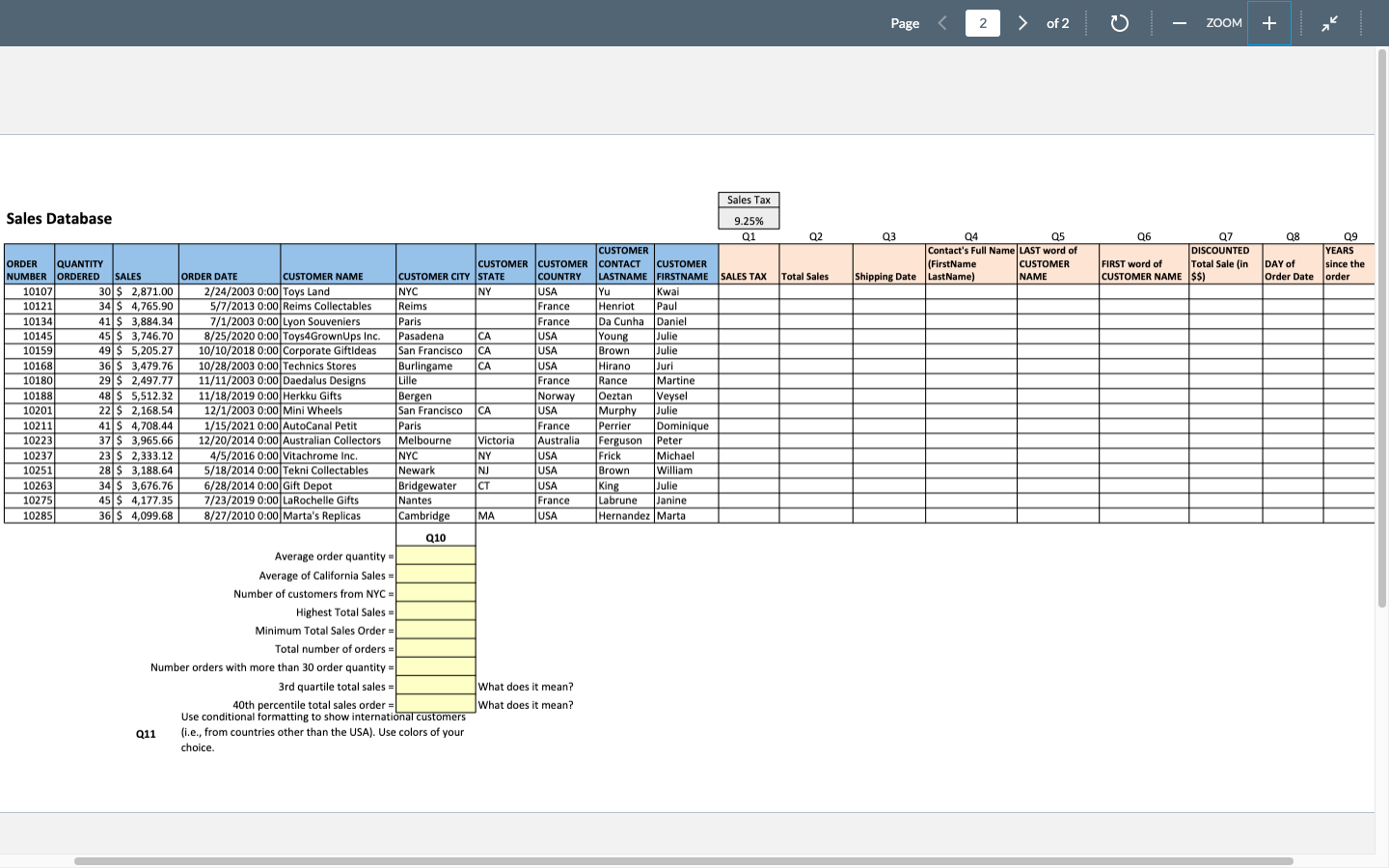

Pos-301: analyzing tax worksheet | Business & Finance homework help POS-301: Analyzing Tax Worksheet ... Social Security Tax Medicare Tax Other (Please specify) Part Two: Sales Tax. 1. List all of the taxes (percent, amount, etc.) found on the receipt. ... Calculate your order. Type of paper. Academic level. Deadline. Pages (275 words) Calculate Sales Tax in Workfront - Adobe Experience League Community ... Workfront Calculate Sales Tax in Workfront Afd1229 Level 1 09-12-2022 12:55 PST How do you calculate sales tax in Workfront? Do I need to create a custom form and then figure out the logic? I'm sure that someone has already done this - calculated sales tax on projects. I would appreciate any tips or documentation on how to accomplish this. Thanks! It is a worksheet where all answer spaces are in boxes and the first ... It is a worksheet where all answer spaces are in boxes and the first question on it says Find the Sales Tax on a sweater you bought. Posted: December 2nd, 2022 Learning Goal: I'm working on a algebra writing question and need an explanation and answer to help me learn.. It is a worksheet where all answer spaces are in boxes and the first question on it says Find the Sales Tax on a sweater ...

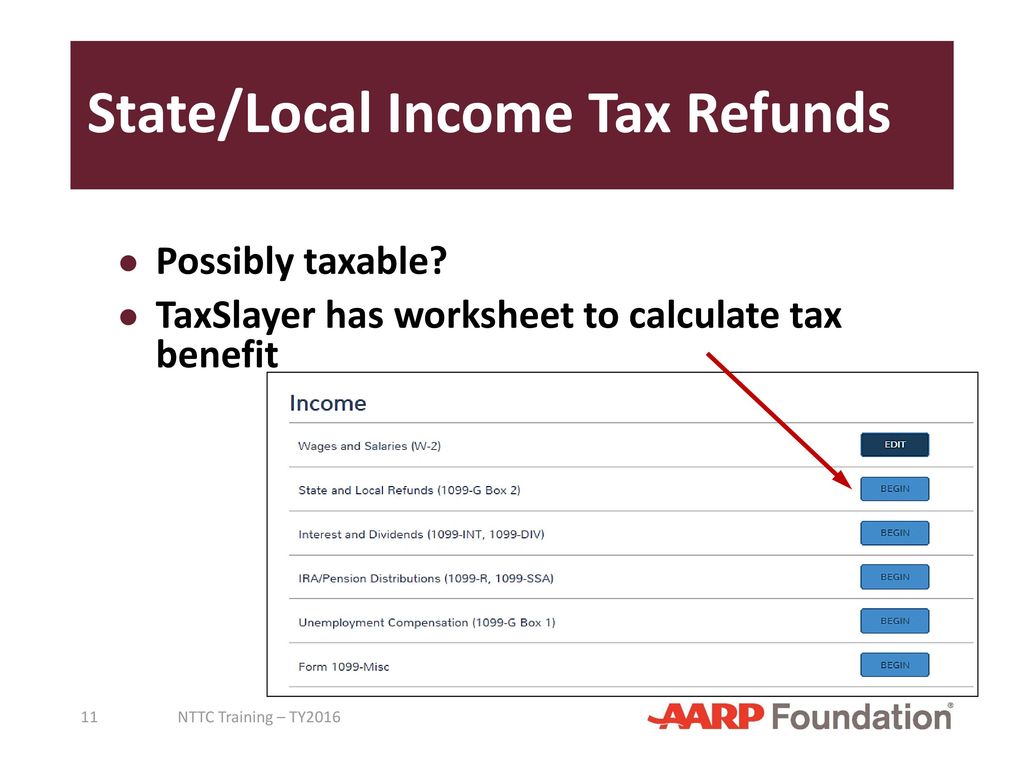

Calculating sales tax worksheet. Configure sales tax for online orders - Commerce | Dynamics 365 The two places where you configure sales tax for a customer account are: Sales tax group on the Invoice and delivery FastTab of the customer details page . Sales tax on the General FastTab of the Manage addresses page. To get there from the customer details page, select a specific address under the Addresses FastTab and then select Advanced. NJ Division of Taxation - Sales and Use Tax Forms Sales Tax Collection Schedule - 6.625% effective 1/1/2018 : Sales and Use Tax: 2018 Jan: ST-50-EN: New Jersey Sales and Use Tax Energy Return: ... Sales and Use Tax: 2017 Feb: ST-50/51: Worksheets for Filing (or Amending) ST-50/51 by Phone - All Quarters EXCEPT 3rd Quarter 2006: Sales and Use Tax: 2017 Feb: ST-3: Resale Certificate: › publications › p505Publication 505 (2022), Tax Withholding and Estimated Tax Use Worksheet 1-1 if, in 2021, you had a right to a refund of all federal income tax withheld because of no tax liability. Use Worksheet 1-2 if you are a dependent for 2022 and, for 2021, you had a refund of all federal income tax withheld because of no tax liability. Worksheet 1-3 Projected Tax for 2022: Project the taxable income you will ... qualified dividend on qualified dividend & capital gain tax worksheet last year line one = $ 1586.00 line two = $2945.00. married filing jointly. line 24 was $159.00 line 25 was zero. IRS just wrote me said I need to pay $159.00. I don't understand. line 11 was $29386.00 if you need to backup that far. 0 3 87 Reply 3 Replies Mike9241 Level 15 a week ago

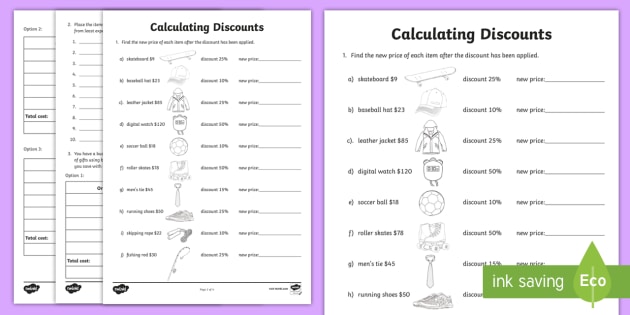

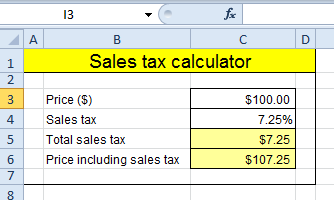

7th Grade Math Sales Tax Study Guide - cms2.ncee.org Sales Tax And Discount - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are Name period date tax tip and discount word problems, Sale price sales tax total cost, Markup discount and tax, Sales tax and discount work, Calculating sales tax, , Percent word problems work 1, Taxes tips and sales. › oes › currentMay 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site. Deductions for Sales Tax - TurboTax Tax Tips & Videos TurboTax will calculate this for you and recommend the best choice. The decision to itemize often includes considering the amount of sales tax you can deduct, even if you make all of your purchases in tax-free states and never even pay any sales tax during the year. What Services Are Exempt from Sales Tax in Ohio In calculating sales tax on this purchase, Steve applies the state tax rate of 5.75% for Ohio plus 1.5% for Montgomery County. At a total sales tax rate of 7.25%, the total cost is $375.38 ($25.38 sales tax). Note: Ohio requires you to file a sales tax return, even if you don`t have sales tax to report.

Frequently Asked Questions About International Individual Tax Matters ... WebWhen am I required to use of the Foreign Earned Income Tax Worksheet when calculating my U.S. income tax? (updated August 2, 2022) If you claimed the foreign earned income exclusion, housing exclusion, or housing deduction on Form 2555, you must calculate your tax liability using the Foreign Earned Income Tax Worksheet (for Line 16) in the Form … Who Is Exempt from Sales Tax in Georgia - Equal Footings The sales and use tax in Georgia is administered by the Georgia Department of Revenue (DOR). Georgia will impose a fine of $5.00 or 5.00% of sales tax due (whichever is greater) for late bids, plus 1,000% interest on the total amount owing. This penalty increases each month to a maximum of $25.00 or 25,000% of the amount owing. Sales Tax Decalculator - Formula to Get Pre-Tax Price from Total Price Step 1: take the total price and divide it by one plus the tax rate Step 2: multiply the result from step one by the tax rate to get the dollars of tax Step 3: subtract the dollars of tax from step 2 from the total price Download the Free Sales Tax Decalculator Template Enter your name and email in the form below and download the free template now! US SaaS sales tax simplified: Guide for 2023 - ramp.com Your business must complete a minimum of 200 transactions in the state to fall under state sales tax jurisdiction. Keep in mind that these economic nexus thresholds are either or. If you earn more than $100,000 in revenue in a state in any given year with under 200 transactions, you're still required to follow that state's tax regulation.

Tournois poker Casino JOA de Cannes - Mandelieu - Club Poker Calendrier des 50 prochains tournois de poker au Casino JOA de Cannes - Mandelieu à Mandelieu La Napoule en Provence-Alpes Côte d'Azur.

Update 17.17 for Microsoft Dynamics 365 Business Central 2020 Release ... Microsoft Dynamics NAV and Microsoft Dynamics 365 Business Central (On Premises) Remote Code Execution Vulnerability

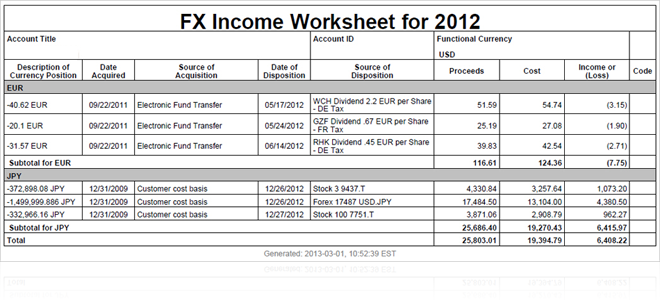

How To Calculate Capital Gains or Losses With a Worksheet - The Balance Preparing and using a worksheet to calculate your gains and losses can help you identify them at tax time and use them to your best advantage. Worksheet 1: Simple Capital Gains Worksheet Let's say you bought 100 shares of Company XYZ stock on Jan. 3, 2021. You bought the 100 shares at $12 per share, for a total cost of $1,200.

› publications › p590bPublication 590-B (2021), Distributions from Individual ... Tax relief for qualified disaster distributions and repayments. Special rules provide for tax-favored withdrawals and repayments to certain retirement plans (including IRAs) for taxpayers who suffered economic losses as a result of certain major disasters. For information about reporting qualified disaster distributions, and repayments; reporting repayments of qualified distributions for home ...

How to Calculate Payroll Taxes in 2023 | Business.org In this publication, the IRS provides a step-by-step worksheet for each method to help you calculate withholding using the tables and your employees' W-4s: Wage bracket method. You'll use the federal income tax tables to find the wage range of your employees' earnings.

dor.mo.gov › formsForms and Manuals - Missouri Forms and Manuals Find Your Form. To search, type a keyword in the Form Number/Name box or choose a Category from the drop-down box below.. To search for archived forms from a previous tax year, choose a year from the Tax Year drop-down box below.

How to Calculate LLC Taxes? (2022 Business Guide) - VentureSmarter To calculate your estimated business taxes, you'll need to estimate your income for the year and determine how much tax you'll owe on that income. You can use the IRS' Estimated Tax Worksheet to help you calculate your estimated taxes. Calculating Self Employment Taxes

Got IRS Notice CP22A [amended return discrepancy] The adjusted taxable income is then used to calculate the tax you owe the IRS, producing the value for line 16 in the 1040. In reviewing all of the downloaded IRS transcripts, there does not appear to be a line for the adjusted taxable income derived by the new worksheet, which was ultimately used to calculate the tax.

Tax Rate Calculation - Texas Comptroller of Public Accounts WebTruth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser — the no-new-revenue tax rate and the voter-approval tax rate. 1 The type of taxing unit determines which truth-in-taxation steps apply. Cities, counties and hospital districts may levy a sales tax specifically to reduce property taxes. …

Publication 505 (2022), Tax Withholding and Estimated Tax WebYou or your spouse start another job, and you chose to use the Multiple Jobs Worksheet or the Tax Withholding Estimator to account for your other job in determining your withholding. You or your spouse start another job, and as a result file a new 2022 Form W-4, and you or your spouse select the checkbox in Step 2(c) (in this case, you must furnish a new Form …

May 2021 National Occupational Employment and Wage Estimates Web31/03/2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site.

r/personalfinance - Looking for tax worksheet to model pretax ... Lastly, take the federal income tax cell and change it to federal taxable wage cell * (federal tax number on paycheck/federal taxable wage number on paycheck) for a rough estimate of that. Repeat same idea for state income tax. It'll be closer than an online calculator but not perfect due to the estimate federal and state income tax rates.

Qualified Dividends And Capital Gain Worksheet - Martin Lindelof Web the qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you. This document is locked as it has been sent for signing. Worksheets are 44 of 107, 2017 qualified dividends and capital gain tax work, qualified dividends and. Web irs introduced the qualified dividend and capital ...

Sales Tax and Discount Worksheet

4 campings à Mandelieu-la-Napoule - CampingFrance.com Vous souhaitez un séjour un séjour en tente, une location mobil-home à Mandelieu-la-Napoule dans un terrain à taille humaine, oudans un beau camping 4 ou 5 étoiles ? Vous trouverez 4 campings à Mandelieu-la-Napoule et 6 campings à proximité. Découvrez CÔTÉ MER, PLATEAU DES CHASSES, LES PRUNIERS.

› travel › plan-bookPer Diem Rates | GSA Nov 14, 2022 · Tax Questions? Have a question about per diem and your taxes? Please contact the Internal Revenue Service at 800-829-1040 or visit . GSA ...

Publication 590-B (2021), Distributions from Individual Retirement ... WebOrdering tax forms, instructions, and publications. Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. Don’t resubmit requests you’ve already sent us. You can get forms and publications …

Lifestyle | Daily Life | News | The Sydney Morning Herald WebThe latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing

Publication 334 (2021), Tax Guide for Small Business WebGetting tax forms, instructions, and publications. ... For information on methods of calculating SE tax, see chapter 10. Table 1-2. Which Forms Must I File? IF you are liable for: THEN use Form: DUE by: 1; Income tax: 1040 or 1040-SR, and Schedule C 2: 15th day of 4th month after end of tax year. Self-employment tax: Schedule SE: File with Form …

Tax Calculation Made Easy: Worksheets To Help You Arrive At Your Tax ... What's the first thing that comes to mind when you think of calculating tax liability? Add up your total income, from salary, business or profession, and look at the income tax slab it fits in. But calculating your tax liability is not that simple.

Capital Gains – 2021 - Canada.ca WebCapital gains from a mortgage foreclosure or a conditional sales repossession will be excluded from net income when calculating your claim for the goods and services tax/harmonized sales tax credit, the Canada child benefit, credits allowed under certain related provincial or territorial programs, and the age amount. You should also exclude …

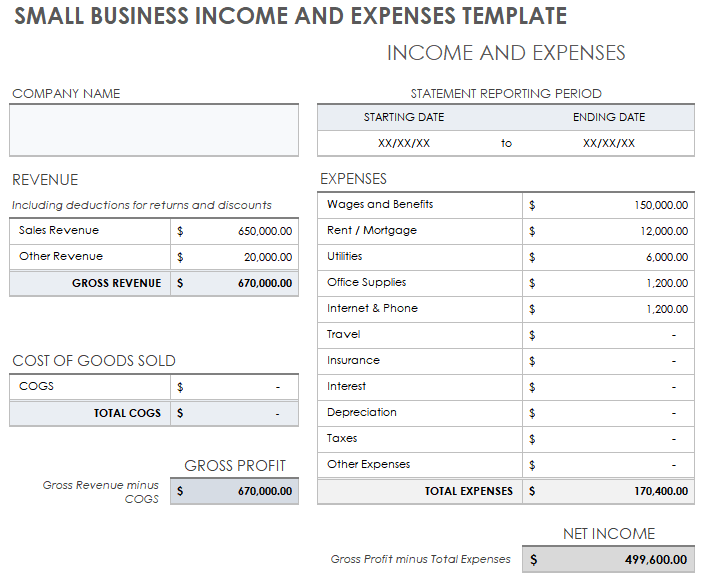

Net Profit Margin - Definition, Formula and Example Calculation Step 1: Write out the formula Net Profit Margin = Net Profit/Revenue Step 2: Calculate the net profit margin for each company Company XYZ: Net Profit Margin = Net Profit/Revenue = $30/$100 = 30% Company ABC: Net Profit Margin = Net Profit/Revenue = $80/$225 = 35.56% Company ABC has a higher net profit margin. Calculation Example #2

11 Free Sales Tax Calculator Apps & Websites 2022 The application is easy to use if you already know the necessary amounts to calculate sales tax. And now let's proceed to the review of this app, and find out why it is so often recommended. With the app, you can calculate the amount and percentage of tax in one click, and you can also do discount calculations and so on.

Marché de Noël - Mandelieu-la-Napoule Lire la suite. Le 10 décembre prochain, le marché de Noël s'installe au cœur du village de la Napoule et sur la Place Fontaine ! Les commerçants présents vous présenteront leurs plus belles créations qui raviront familles et amis. Bien évidemment des bijoux, des objets de décorations pour les chambres d'enfants, des accessoires de ...

How Do I Calculate Estimated Taxes for My Business? You can calculate your estimated business taxes using IRS Schedule C, which you must submit with your Form 1040 tax return when you file it. Include all sources of income in addition to your business income and self-employment tax, including: Salary Tips Pension Dividends Alternative minimum tax Winnings, prizes, and awards

› individuals › international-taxpayersFrequently Asked Questions About International Individual Tax ... If you claimed the foreign earned income exclusion, housing exclusion, or housing deduction on Form 2555, you must calculate your tax liability using the Foreign Earned Income Tax Worksheet (for Line 16) in the Form 1040 and 1040-SR Instructions or your income tax preparation software.

What is the AMT? | Tax Policy Center WebAfter calculating their regular income tax, some middle- and upper-income taxpayers must add AMT “preference items” to their taxable income, subtract an AMT exemption amount, and recalculate their tax using the AMT tax rate structure. AMT liability is the excess, if any, of this amount over the amount of tax owed under the regular income tax rules.

It is a worksheet where all answer spaces are in boxes and the first ... It is a worksheet where all answer spaces are in boxes and the first question on it says Find the Sales Tax on a sweater you bought. Posted: December 2nd, 2022 Learning Goal: I'm working on a algebra writing question and need an explanation and answer to help me learn.. It is a worksheet where all answer spaces are in boxes and the first question on it says Find the Sales Tax on a sweater ...

Calculate Sales Tax in Workfront - Adobe Experience League Community ... Workfront Calculate Sales Tax in Workfront Afd1229 Level 1 09-12-2022 12:55 PST How do you calculate sales tax in Workfront? Do I need to create a custom form and then figure out the logic? I'm sure that someone has already done this - calculated sales tax on projects. I would appreciate any tips or documentation on how to accomplish this. Thanks!

Pos-301: analyzing tax worksheet | Business & Finance homework help POS-301: Analyzing Tax Worksheet ... Social Security Tax Medicare Tax Other (Please specify) Part Two: Sales Tax. 1. List all of the taxes (percent, amount, etc.) found on the receipt. ... Calculate your order. Type of paper. Academic level. Deadline. Pages (275 words)

0 Response to "45 calculating sales tax worksheet"

Post a Comment