45 tax write off worksheet

31 Best Tax Deductions for Truckers, Truck Drivers & Owner Operators Any monthly payment you pay for your vehicle lease is a tax write off. For example if you lease your truck or tractor for $1500 per month you get to write of $18000 Per year as Lease expenses. Employee Payroll (Need to Issue W2 to employees & File and Pay Payroll taxes) Private Practice Tax Write-Offs | Free PDF Checklist First of all, when you run your own business, the IRS lets you write off the majority of your expenses. This means that you get to deduct your expenses from your income, and primarily pay taxes on what's left. This is amazing! Many of you are likely not aware of this benefit and are paying money to the IRS that you don't owe them.

Publication 535 (2021), Business Expenses - IRS tax forms Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

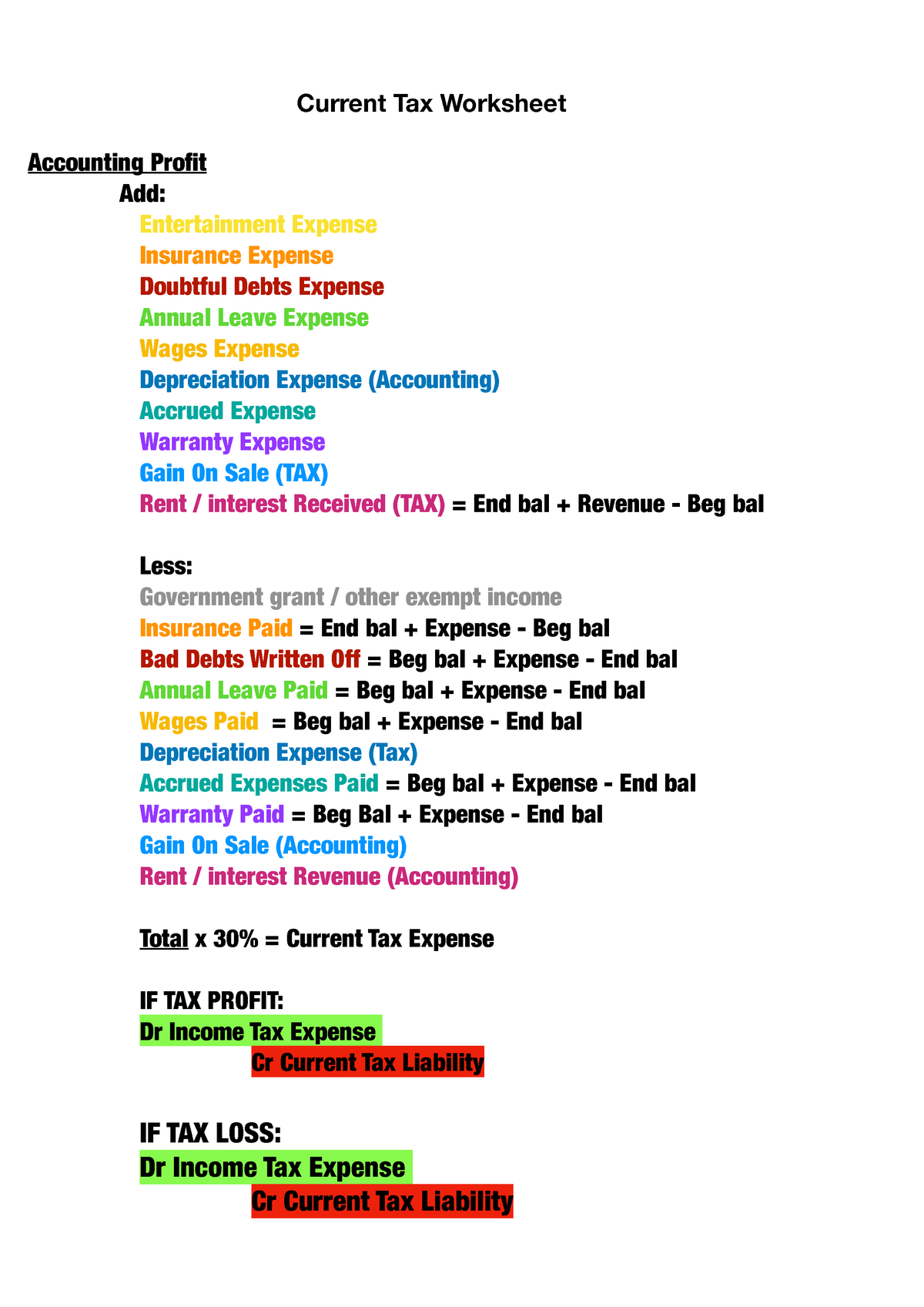

Tax write off worksheet

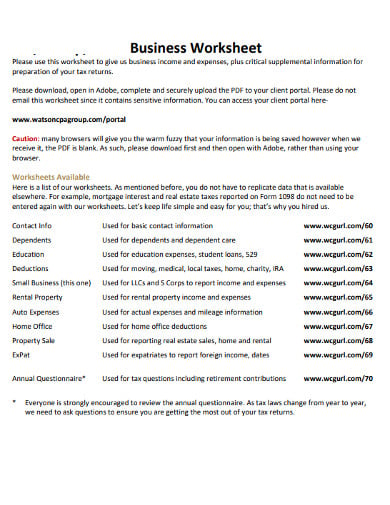

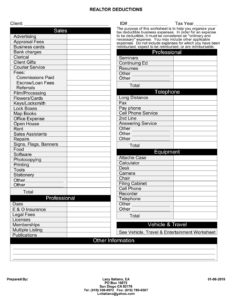

Free Tax Forms & Worksheets | Tax Preparation & Bookkeeping The purpose of these forms and worksheets is so you can be as prepared as possible so the tax preparation process is quick and painless as possible. We have created over 25 worksheets, forms and checklists to serve as guidance to possible deductions. There are over 300 ways to save taxes and are presented to you free of charge. Realtor Tax Deduction Worksheet Form - signNow Follow the step-by-step instructions below to design your rEvaltor tax deduction worksheet form: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done. Top 21 Tax Deductions & Tax Tips for Network Marketers Top 21 Tax Deductions for Network Marketers. Here are the common categories on a Schedule C: # 1: Advertising. This could include business cards, buying leads, flyers, participation in an advertising COOP with your upline, sample products, newspaper ads, postcards, pay-per-click ads, or any type of online or offline advertising that you might do to generate leads, find prospects or make more ...

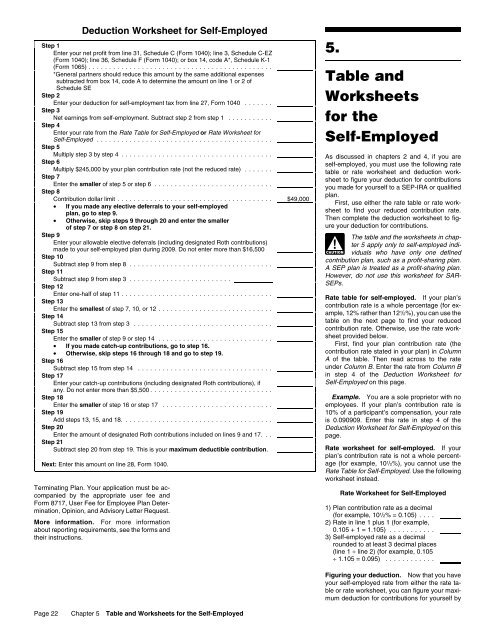

Tax write off worksheet. TAX ORGANIZERS - Riley & Associates: Certified Public Accountants Excel Tax Organizer 2021 Year-End Tax Letter Universal Tax Deduction Finder 2021 (pdf) Tax Apps (pdf) Tax Organizer for Estates & Trusts (pdf) Tax Organizer for Small Corporations (pdf) Engagement Letter Downloadable Riley & Associates Engagement Letter (.PDF Adobe Acrobat Format) Profession Specific Deduction Checklist Independent Contractor Expenses Spreadsheet [Free Template] - Keeper Tax See write-offs 1. Schedule C Expense Categories This first tab is your bread and butter. All you need to do here is customize it with your name, and fill in your business-use percentages. (Those boxes are in yellow — hover over the cell for notes!) Everything else here will show up automatically, based on what you enter in the other two tabs. 2020/2021 Tax Estimate Spreadsheet - Michael Kummer If you are looking to find out if you will get a tax refund or if you owe money this year, here is a simple Excel spreadsheet that can help you estimate federal and state income taxes before you file your return in 2021. The formulas and spreadsheets shown and linked below take the new tax reform and tax cuts into account that went into effect ... How To Write Off Taxes For MLM Business | Tax Relief Center Though you cannot deduct personal trips, you can write off expenses for business trips and maintenance costs. You can even deduct the costs of meals and supplies for sales presentations. You can easily write off taxes for MLM business. Take these deductions, so you can survive and thrive in the market. They will save you a lot of money and will ...

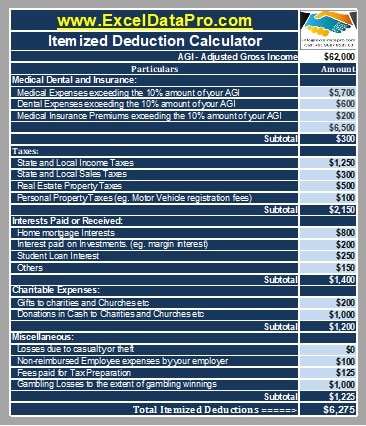

The Best Home Office Deduction Worksheet for Excel [Free ... - Keeper Tax The worksheet will automatically calculate your deductible amount for each purchase in Column F. If it's a "Direct Expense," 100% of your payment amount will be tax-deductible. If it's an expense in any other category, the sheet will figure out the deductible amount using your business-use percentage. Dragging down the deductible amount formula Tax Deduction | Excel Templates 1. Use the checklist provided for ideas on what tax deductions would make sense for you. Simply read the different titles to which one is going to make the most sense for yourself. If you find you do not need certain categories, feel free to remove them or change them into something else that works better for your home or business taxes. 2. PDF Tax Worksheet for Self-employed, Independent contractors, Sole ... make sure I have your last year's tax return so I can follow it. Otherwise, answer the following: Date you purchased the property ... ***Please email or fax worksheet De'More Tax Service Office: 817-726-2181 Mobile: 972-885-9709 Fax: 206-736-0982 Email: taxes@demoretaxservice.com Email: demoretaxservice@gmail.com . An Updated Tax Write-Off Worksheet, by the Nosiest Employee at the IRS An Updated Tax Write-Off Worksheet, by the Nosiest Employee at the IRS | Points in Case An Updated Tax Write-Off Worksheet, by the Nosiest Employee at the IRS Who kept the dog? by Kelsey Harper | April 5, 2022 Did you receive a stimulus payment (Notice 1444-C or Letter 6475)? Did you receive wages (Form W-2)?

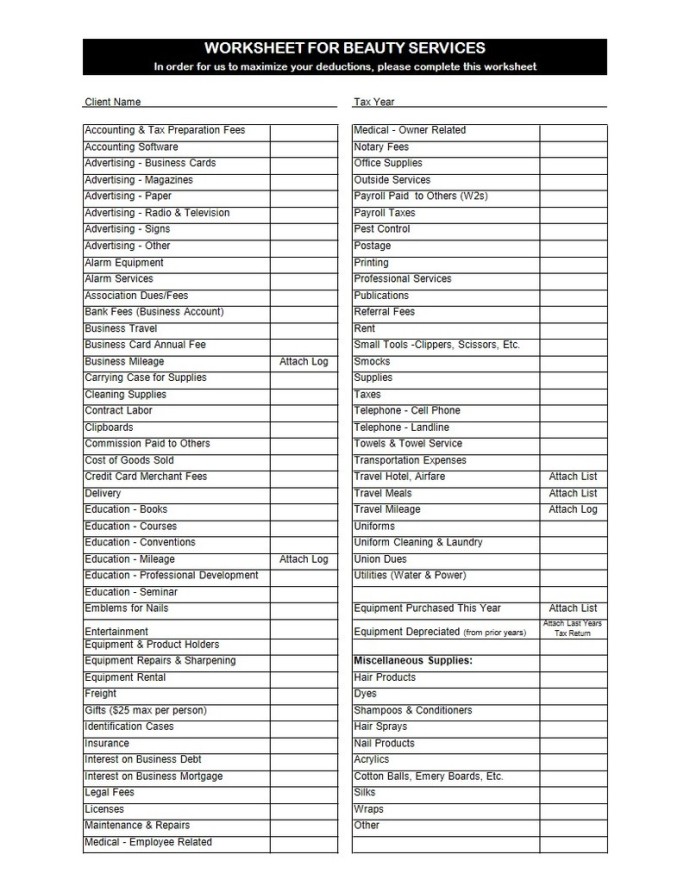

Tax Preparation Checklist. Collect Your Forms Before you e-File. With eFile, you can file your individual income tax return, including all your income from wages or employment, your small business, retirement, stocks and investments, and other income. List of Tax Preparation Forms, Documents Use the checklist below to gather your documents and other forms that you will need to file your taxes. Hairstylist Tax Write Offs Checklist for 2023 | zolmi.com Here are the most common tax write offs for self employed hairstylist deductions: Professional Expenses: These common hairstylist tax write-offs include things that you deduct because they're necessary for running your business, like legal fees or salon accounting services. 19 Truck Driver Tax Deductions That Will Save You Money Truck repairs and maintenance. Since your truck is considered a qualified, non-personal-use vehicle, you can deduct 100% of all the costs to repair and maintain. This includes tires or getting your vehicle washed. Additional vehicle expenses include depreciation, as well as loan interest if you financed the purchase. Tax Spreadsheet For Self Employed - Tax Twerk Doing Your Own Tax Spreadsheets Throughout the year, and as you make money from your home business or other self owned business, you can estimate the Self Employment Taxes that you're going to owe utilizing another handy, easy-to use spread sheet that can be found here. It's also a free printable option.

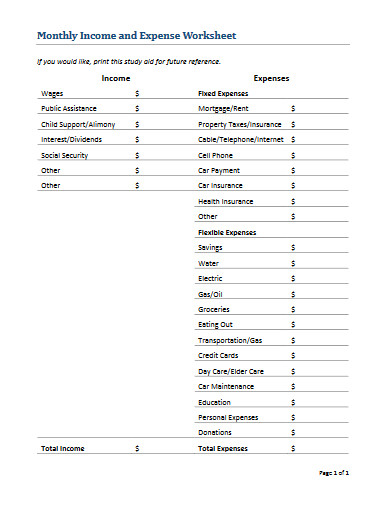

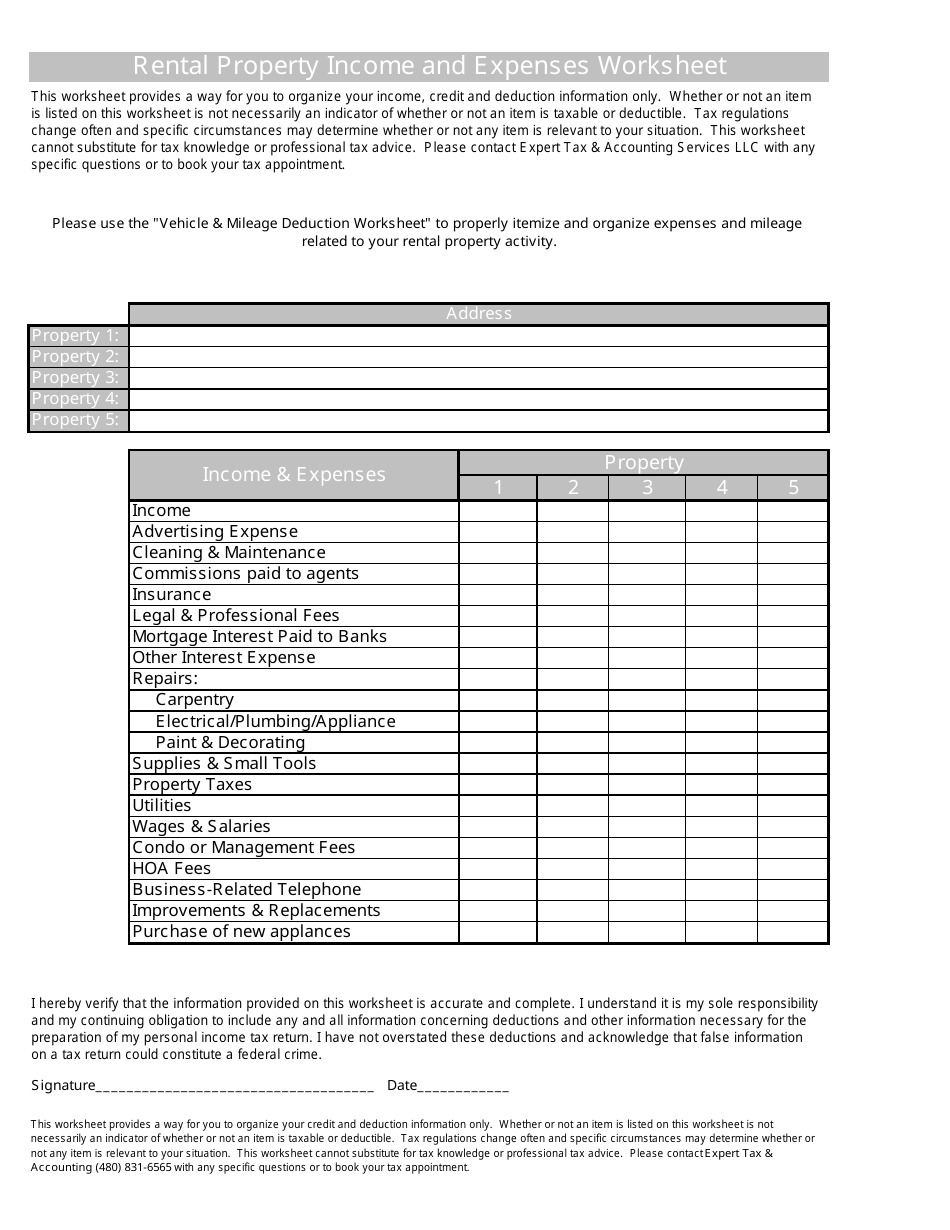

Rental Income and Expense Worksheet - Rentals Resource Center To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category.

PDF SMALL BUSINESS WORKSHEET - cpapros.com SMALL BUSINESS WORKSHEET Client: ID # TAX YEAR ORDINARY SUPPLIES The Purpose of this worksheet is to help you organize Advertising your tax deductible business expenses. In order for an Books & Magazines expense to be deductible, it must be considered an Business Cards "ordinary and necessary" expense. You may include

The Ultimate Small Business Tax Deductions Worksheet for 2022 Assuming your effective tax rate is 20%, that $5,000 tax deduction will save you $1,000. Without deductions: $50,000 x .2 = $10,000 With deductions: $45,000 x .2 = $9,000 Savings: $10,000 - $9,000 = $1,000 Over the course of the tax year, record business-related expenses so you can easily tell which costs are deductible when it's tax time.

Guide to Tax Deductions for Nonprofit Organizations - FreshBooks Below are some of the most common write-offs for charitable organizations that need them. 1. Compensation for Staff Members. Employee wages and benefits are some of the most common and important deductions to include on a tax return. This is partly due to how much of the budget these costs take up throughout the year.

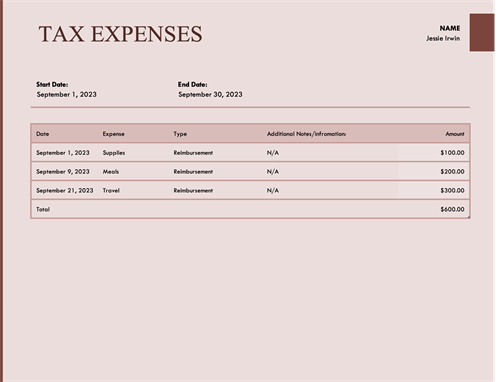

Tax expense journal - templates.office.com Track your tax expenses with this accessible tax organizer template. Utilize this tax expense spreadsheet to keep a running total as you go. Take the stress out of filing taxes with this easy-to-use tax deduction spreadsheet. Excel Download Open in browser Share More templates like this Retirement readiness checklist Word Loan amortization schedule

Downloadable tax organizer worksheets This downloadable file contains worksheets for, wages and pensions, IRA distributions, interest and dividends, Miscellaneous income (tax refunds, social security, unemployment, other income). Don't forget to attach W-2's and 1099 forms to you worksheets. business.pdf. This file contains worksheets for self employed business, employee business ...

Real Estate Agent Tax Deduction Wordsheet - Google Sheets Sheet1 Sales,Professional Advertising,seminars Appraisal Fees,Continuing Ed Business Cards,Resumes Bank Charges,Teleophone Clerical,Cell Phone Client Gifts,Cell Plan Courier Services,Equipment Commission Fees,Office Supplies Escrow Fees,Computer Referral Fees,Tablet Flim Production,Vehicle Flowers

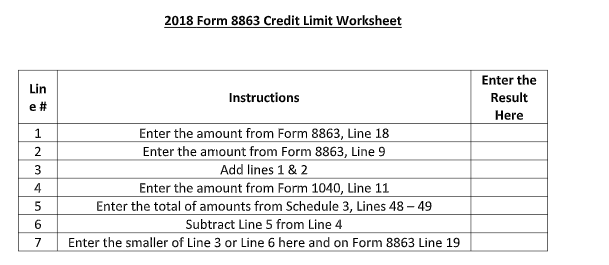

1040 (2021) | Internal Revenue Service - IRS tax forms If you are a fiscal year filer using a tax year other than January 1 through December 31, 2021, write "Tax Year" and the beginning and ending months of your fiscal year in the top margin of page 1 of Form 1040 or 1040-SR.

FREE Home Office Deduction Worksheet (Excel) For Taxes - Bonsai The Simplest Do It Yourself Option - A Home Office Deduction Worksheet If you are already keeping track of your expenses on your own then using a spreadsheet with all of the calculations built-in should be a straightforward process. If the spreadsheet has the necessary calculations built-in then are a few tax definitions worth remembering.

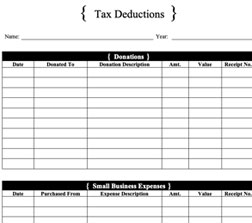

PDF Tax Deduction Worksheet - Oxford University Press Tax Deduction Worksheet . This worksheet allows you to itemize your tax deductions for a given year. Tax deductions for calendar year 2 0 ___ ___ HIRED HELP SPACE $_____ Accountant

Tax Deductions for Photographers - FreshBooks - FreshBooks Top 7 Tax Write-offs for Photography Businesses If you own a small photography company, there are numerous ways to take advantage of legal deductions according to the tax code. Many entrepreneurs and sole proprietors use form Schedule C to record them. The list below includes some of the most common photographers tax deductions you can leverage.

Top 21 Tax Deductions & Tax Tips for Network Marketers Top 21 Tax Deductions for Network Marketers. Here are the common categories on a Schedule C: # 1: Advertising. This could include business cards, buying leads, flyers, participation in an advertising COOP with your upline, sample products, newspaper ads, postcards, pay-per-click ads, or any type of online or offline advertising that you might do to generate leads, find prospects or make more ...

Realtor Tax Deduction Worksheet Form - signNow Follow the step-by-step instructions below to design your rEvaltor tax deduction worksheet form: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

Free Tax Forms & Worksheets | Tax Preparation & Bookkeeping The purpose of these forms and worksheets is so you can be as prepared as possible so the tax preparation process is quick and painless as possible. We have created over 25 worksheets, forms and checklists to serve as guidance to possible deductions. There are over 300 ways to save taxes and are presented to you free of charge.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6238fcf2e45bd9fa5a86e28d_schedule-c-categories.png)

0 Response to "45 tax write off worksheet"

Post a Comment