39 funding 401ks and roth iras worksheet

Personal Defined Benefit Plan - Charles Schwab Download, print, and fill out the Funding Proposal Worksheet. Return your completed Schwab Personal Defined Benefit Plan Funding Proposal Worksheet to Schwab. Schwab Personal Defined Benefit Department Charles Schwab & Co., Inc. P.O. Box 407 Richfield, OH 44286-0407 Fax: 800-977-8814 personal finance worksheet answers Funding 401ks And Roth Iras Worksheet - Worksheet List nofisunthi.blogspot.com. worksheet flowchart 401ks roth funding iras prioritize redesigned spending money. Balancing Your Checking Account Worksheet Answers ivuyteq.blogspot.com. balancing checkbook ivuyteq.

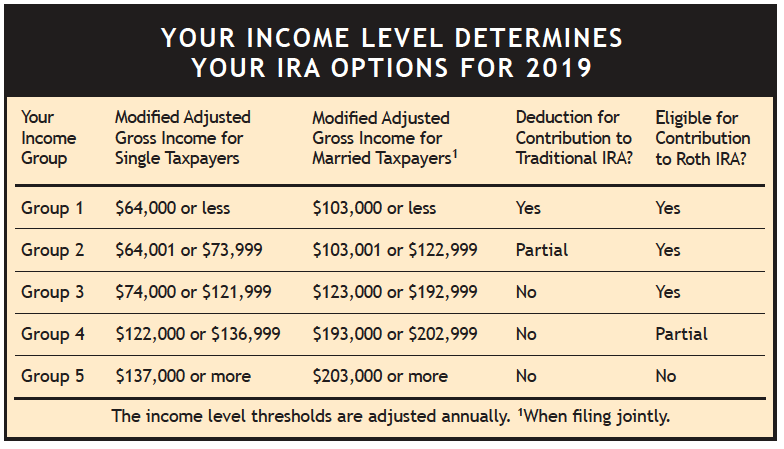

2022 2023 2024 Medicare Part B IRMAA Premium MAGI Brackets 13.10.2022 · Looks like Medicare just announced the irmaa income brackets for 2021 and Harry Sit was exactly right $88,000/ $176,000. I’m still waiting to do Roth conversions and/or stock capital gains this year until I get more info on future irmaa bracket possibilities. Not sure if they can dip below $85,000/ $170,000. It would be nice to know that 2022 ...

Funding 401ks and roth iras worksheet

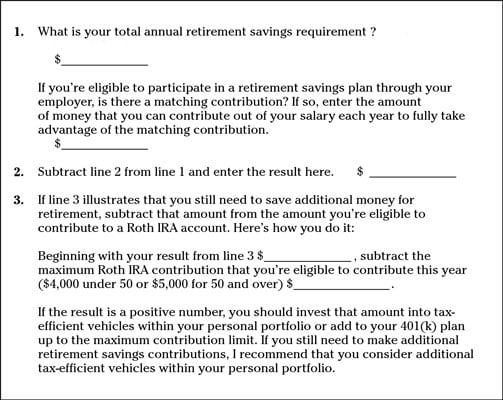

Funding a 401 K and Roth - financial lit Flashcards | Quizlet -They match what you put into your 401 (k) -Up to 3% of your salary -If you make $100,000 and you put $3,000 or more into your 401 (k) -Your company will also put $3,000 into your 401 (k) FOLLOW THESE STEPS TO FUND YOUR 401 (K) & ROTH IRA -Calculate 15% or your income >>This is the total you want to invest in your retirement accounts QLAC | Qualified Longevity Annuity Contracts - Annuity.org QLACs are relatively new. The U.S. Treasury Department in 2014 issued rules letting people with qualified retirement plans — such as traditional 401(k) plans, 403(b) plans or traditional individual retirement accounts (IRAs) — use retirement savings to purchase QLACs. But you cannot purchase a QLAC with a Roth IRA or an inherited IRA. Modified Adjusted Gross Income (MAGI) - Obamacare Facts 08.01.2015 · If the amount on line 6 of Worksheet 1-1 above is less than zero, seeLine 3, later, before you enter an amount on Form 8962, line 3. Line 2b. Enter the modified AGI for all of your dependents on line 2b. Use the worksheet below to figure the combined modified AGI for the dependents claimed as exemptions on your return. Only include the modified ...

Funding 401ks and roth iras worksheet. Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET Step 1: Calculate 15% of the total annual salary Step 2: Calculate the maximum match that can be contributed to the 401 (K) Step 3: Calculate the remaining balance into the ROTH IRA column Exceptions * if there is no match, put the maximum amount into the ROTH IRA first, and the remaining into 401 (k) Funding a Roth IRA Using 401(k) After-Tax Contributions - Retirement ... A conversion to a Roth IRA that includes pre-tax dollars is a taxable event. Because of the basis recovery rules that apply to withdrawals from 401(k) after-tax accounts, a participant must consider any pre-tax amount converted as ordinary income in the year of the conversion. Funding 401 K S And Roth Iras Worksheet Answers Funding 401ks And Roth Iras Worksheet Promotiontablecovers . It was coming from reputable online resource and that we love it. Funding 401 k s and roth iras worksheet answers. A funding 401 k s and roth iras worksheet answers is a few short questionnaires on a certain topic. A worksheet, get sheet name a workbook includes a selection of worksheets. Funding 401(K)S And Roth Iras Worksheet Answers Pdf - Free Gold IRA ... Funding 401(K)S And Roth Iras Worksheet Answers Pdf Overview Funding 401(K)S And Roth Iras Worksheet Answers PdfA gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares."

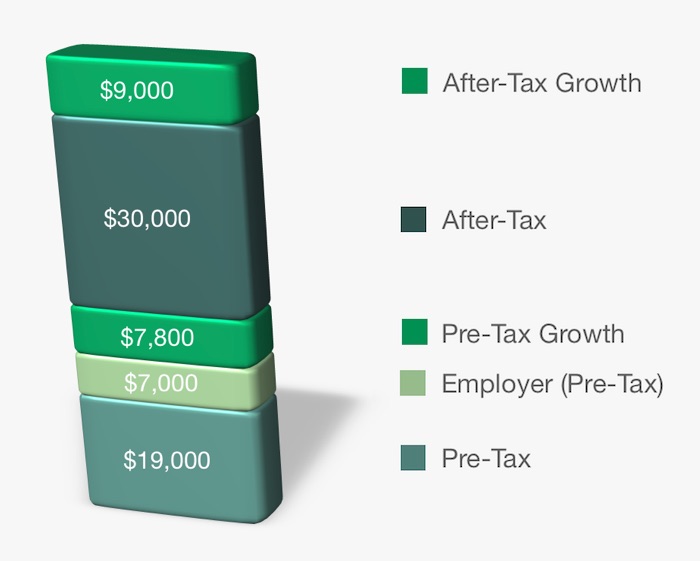

Funding 401Ks And Roth Iras Worksheet Answers Pdf - Wakelet How to Know Your Students• gathering information about the students; • engaging students and parents during the course of information gathering; • processing information in order to develop an understanding of each students strengths, learning style (s), preferences, needs, interests, and readiness to learn; • selecting andor developing ... 401(k) and roth ira Flashcards | Quizlet differences between roth ira and 401k roth- by yourself; taxed before investing (after tax money); yearly max contribution and income limitations 401k- can be matched by an employer; taxed in retirement (pre-tax money); no max contribution steps for investing in roth ira or 401k 1. calculate target amount to invest (15%) Solved Activity: Funding 401(k)s and Roth IRAs Objective ... - Chegg Activity: Funding 401 (k)s and Roth IRAs Objective: The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement investments. Directions: Complete the investment chart based on the facts given for each situation. Forms & Applications | Charles Schwab Combining 401ks Other IRAs ... Roth IRA Apply Online: Not currently available ... Personal Defined Benefit Plan Funding Proposal Worksheet Download: SIMPLE IRA ...

Funding 401(k)s & Roth IRAs Chart.docx - Funding 401(k)s - Course Hero Funding 401 (k)s & Roth IRAs Directions: Complete the investment chart based on the facts given for each situation. All of the people are following good sound advice and investing 15% (change to .15 to multiply by their annual salary to come up with their Total Annual Investment) of their annual household income for retirement. Amount of Roth IRA Contributions That You Can Make For 2023 Amount of your reduced Roth IRA contribution. If the amount you can contribute must be reduced, figure your reduced contribution limit as follows. Start with your modified AGI. Subtract from the amount in (1): $218,000 if filing a joint return or qualifying widow (er), $-0- if married filing a separate return, and you lived with your spouse at ... PDF NAME: DATE: Funding 401(k)s and Roth IRAs - MRS. JENKINS BUSINESS CLASS ... Melissa will fund the 401(k) up to the match and put the remainder in her Roth IRA. Tyler and Megan can each fund a Roth IRA then put the remainder in the 401(k). With no match, fund the Roth Þrst (based on 2013 contribution of $5,500 per individual). Adrian is not eligible to open a Roth IRA because he makes too much money. 2022 Free Funding 401 K S And Roth Iras Worksheet Answers Funding 401(k)s and roth iras worksheet answer key overview. Source: nofisunthi.blogspot.com The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement. Funding 401(k)s and roth iras directions complete the investment chart based on the facts given for each situation.

20++ Funding 401 K S And Roth Iras Worksheet Answers A funding 401 k s and roth iras worksheet answers is a few short questionnaires on a certain topic. Do student activity sheet, 401(k) and roth ira. Source: db-excel.com. The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement. All of the people are following good ...

PDF Roth vs. Traditional 401(k) Worksheet - Morningstar, Inc. An increasing number of 401(k) plans are offering a Roth option. The key differences are as follows: Traditional 401(k) p Pretax contributions p Tax-deferred compounding p Taxed upon withdrawal in ...

Wk 5_Funding 401ks and Roth IRAs Answer Sheet.xlsx Chapter 11: Funding 401 (k)s and Roth IRAs Answer Sheet Possible 40 points - each answer is worth a possible 2 points Investment Annual Salary Company Match 401 (k) Roth IRA Joe $ 40,000 1:1 up to 5% $ 2,000 $ 4,000 $ 6,000 Melissa $ 55,000 1:2 up to 6% $ 3,300 $ 4,950 $ 8,250 Tyler & Megan $ 105,000 No Match

Can You Have A Roth IRA And 401K? - Forbes Advisor Tax Considerations for a 401 (k) and a Roth IRA. While saving in a Roth IRA doesn't offer you any tax advantages today, the future advantages can add up. "Keep in mind how important—or not ...

Complete Funding 401ks and Roth IRAs Worksheet.jpg - NAME:... Complete Funding 401ks and Roth IRAs Worksheet.jpg - NAME: DATE: Funding 401 (k)s and Roth IRAs Directions Complete the investment chart based on the | Course Hero Complete Funding 401ks and Roth IRAs Worksheet.jpg - NAME:... School No School Course Title AA 1 Uploaded By cereeseblose Pages 1 Ratings 100% (12)

personal finance worksheet answers Coloring Pages Kids: Free Printable Business Math Worksheets gojekan101.blogspot.com. worksheets business grammar printable worksheet math mixed coloring practices. Balancing Your Checking Account Worksheet Answers ivuyteq.blogspot.com. balancing checkbook ivuyteq. Funding 401ks And Roth Iras Worksheet - Worksheet List nofisunthi.blogspot.com

Funding 401ks and roth iras worksheet answers? - eyelight.vn View Complete Funding 401ks and Roth IRAs Worksheet.jpg from AA 1NAME: DATE: Funding 401(k)s and Roth IRAs Directions Complete the investment chart based on …. => Read Now Activity_Funding_A_401k_And_… Students should first compute 15% of the annual salary to get thetotal annual amount. AnswersFunding 401(k)sand Roth IRAs …. => Read Now

Activity_Funding_A_401k_And_Roth_IRA.pdf - 8 CHAPTER... Review the steps to follow when funding a 401 (k) and Roth IRA, located in the workbook: 1 Always take advantage of a match and fund 401 (k). 2 Above the match, fund Roth IRAs. If there is no match, start with Roth IRAs. 3 Complete 15% of income by going back to your 401 (k) or other company plans.

Modified Adjusted Gross Income (MAGI) - Obamacare Facts 08.01.2015 · If the amount on line 6 of Worksheet 1-1 above is less than zero, seeLine 3, later, before you enter an amount on Form 8962, line 3. Line 2b. Enter the modified AGI for all of your dependents on line 2b. Use the worksheet below to figure the combined modified AGI for the dependents claimed as exemptions on your return. Only include the modified ...

QLAC | Qualified Longevity Annuity Contracts - Annuity.org QLACs are relatively new. The U.S. Treasury Department in 2014 issued rules letting people with qualified retirement plans — such as traditional 401(k) plans, 403(b) plans or traditional individual retirement accounts (IRAs) — use retirement savings to purchase QLACs. But you cannot purchase a QLAC with a Roth IRA or an inherited IRA.

Funding a 401 K and Roth - financial lit Flashcards | Quizlet -They match what you put into your 401 (k) -Up to 3% of your salary -If you make $100,000 and you put $3,000 or more into your 401 (k) -Your company will also put $3,000 into your 401 (k) FOLLOW THESE STEPS TO FUND YOUR 401 (K) & ROTH IRA -Calculate 15% or your income >>This is the total you want to invest in your retirement accounts

![Asset Allocation Spreadsheet [Excel Template] | White Coat ...](https://www.whitecoatinvestor.com/wp-content/uploads/2020/12/Screen-Shot-2020-12-03-at-8.18.51-AM.png)

![How to Do a Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2020/06/Screen-Shot-2020-06-20-at-7.44.13-AM.png)

![How to Do a Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2021/01/form-8606-p1.png)

0 Response to "39 funding 401ks and roth iras worksheet"

Post a Comment